July 22, 2022

In such a competitive market, sellers and real estate agents must stay on top of emerging technologies to publish lucrative and attractive listings. Creating a virtual tour of the property gives potential buyers an interactive and immersive experience that is impossible to replicate with still photos. What is a virtual tour? Virtual tours are a simulation of an existing real estate property that i...

July 15, 2022

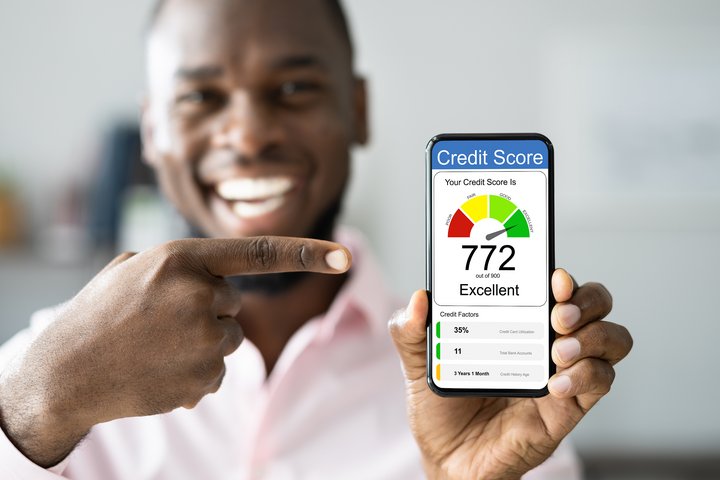

Whether applying for a credit card or a mortgage, a good credit score is a must to receive approvals with favorable terms. However, it is challenging to know what steps to take to improve your credit score without knowing what factors carry the most weight. With so many of your future financing options relying on your credit score, it is essential to understand how it gets calculated. Thus, we cre...

July 8, 2022

When budgeting for your monthly bills, you may wonder whether it’s best to pay off your credit card balances in full or make partial payments to free up funds for another purpose. Many also wonder if paying at least the minimum payment by the due date is best practice or if they should wait until they can pay the balance in full. Your decisions on these matters can either benefit or harm you...

July 1, 2022

Creating appealing visual content should be at the center of your social media strategy. Across all platforms, using images boosts viewership and engagement, but how do you create social media graphics that your audience will love? This article explores ten hacks your team can use to create stellar social media graphics, even without a professional graphic designer. Hone in on one goal per graphic...

June 24, 2022

Like individuals, businesses also receive a credit score. If you intend on getting financing for your business, you must prioritize understanding how to access, read, and improve your business credit scores and reports. What is a business credit score? A business credit score is a numerical measure that indicates how responsible and creditworthy a company is. With a higher score, you will pay less...

June 17, 2022

In 2022, MetLife and the U.S. Chamber of Commerce conducted a survey that found that 85% of small business owners are concerned about this year's inflation and its effects on their businesses. They have found themselves in a challenging situation since they must try to keep their business expenses from skyrocketing while trying to appease their customers' more frugal spending habits. For...

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share