** DRAFT - NOT PUBLICALLY VISIBLE **

The U.S. economy continued to grow at a steady rate halfway through the third quarter, despite the recent turmoil in global financial markets triggered by concerns over slowing economic growth in China. Data on automobile sales, employment and the services sector have indicated a constant build-up of economic momentum at the start of the third quarter – after the gross domestic product expanded at a 2.3% annually in the second quarter.

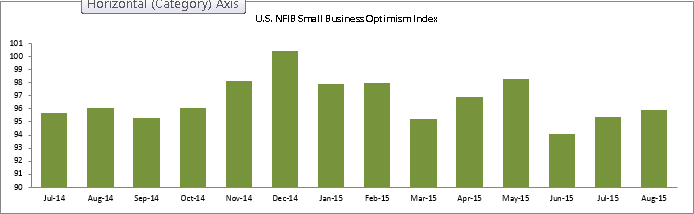

U.S. small business confidence rebounded in July from a 15-month low in June, and continued to grow in August, although at a slower pace. Owners anticipate solid sales and inventory growth, providing another boost to the economic outlook for the third quarter.

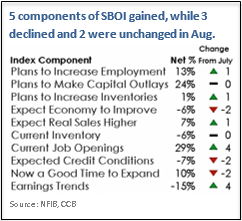

The Small Business Optimism Index (SBOI), under the survey of 656 businesses by the National Federation of Independent Business (NFIB), indicates optimism was not significantly impacted by the global financial crisis. “Most of the interviews were completed before the big slide,” the NFIB said in a statement.

Based on 10 survey indicators, the SBOI gained half a point to 95.9 in August after registering a 1.3 point rise in the previous month.

About 14% of small business owners reported slashing their average selling prices in the past three months, up one point from July. About 15% planned to raise prices, down 2 points from July.

About 14% of small business owners reported slashing their average selling prices in the past three months, up one point from July. About 15% planned to raise prices, down 2 points from July.

The modest increase in the SBOI in August was primarily attributed to the slowdown in the job growth during the month. The U.S. Labor Department reported non-farm payroll increases of 173,000 last month, the smallest gain in five months.

Last week’s lower than expected job growth pulled down mortgage rates a bit. The 30-year fixed mortgage rate is currently 3.74%, down one basis point from this time last week.

“Rates dipped slightly last week following a mildly disappointing jobs report but quickly rebounded, ending the week where they began,” said Erin Lantz, Vice President of Mortgages at Zillow. The rate for a 15-year fixed home loan is currently 2.9%, while the rate for a 5-1 adjustable-rate mortgage (ARM) is 2.66%.

The New Labor Law Ruling

Just when we were growing confident of the U.S. construction industry, the National Labor Relations Board (NLRB) has proposed a new labor law ruling that has created unrest among the home builders. Under this ruling, the NLRB could, in some cases, deem workers “joint employees” of the home builders. Roofers, plumbers, electricians and framers are just some of the 25 categories of subcontractors used to build a home.

“The home building industry, which is primarily made up of small businesses that rely greatly on the work of subcontractors, would overwhelmingly be harmed by the new standard,” said Tom Woods, chairman of the National Association of Home Builders (NAHB) in a release.

The NLRB feels that the previous joint employer standard has failed to keep pace with changes in the workplace and economic circumstances. It is unclear how exactly the decision will affect builders; however, they stand ready to fight the ruling as soon as a case arises.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share