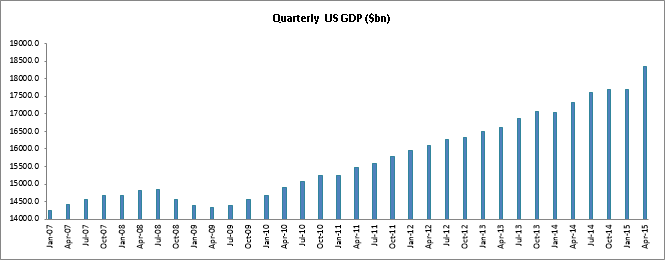

The third quarter of the fiscal year could be exciting as signaled by a strong rebound in the US economy – with the final GDP growth rate reading of 3.9% in the second quarter.

Economists expect the third quarter GDP to grow by 2.3% per annum. Eyes will be on consumer spending as well as construction activities that primarily led to the gains in second quarter GDP, which was well above the first quarter growth rate of 0.6% per annum and better than the prior estimates of 3.7%. Consumers are spending more on healthcare, food services and accommodations, while the higher business investments in residential and non residential buildings are driving growth in the construction industry.

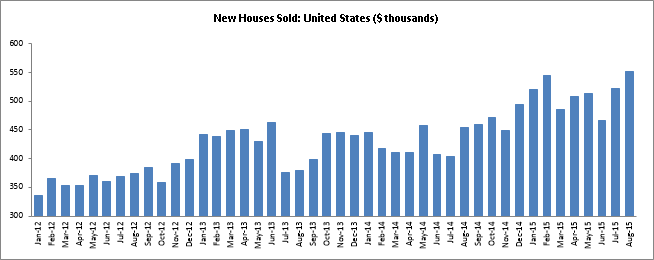

More New Homes in 3Q

The third quarter could see higher new home sales. They touched a seven-and-a-half year high in August, while existing home sales disappointed. New home sales rose 5.7% to 552,000 in August following an upwardly revised 12% jump to 522,000 in July. August home sales exceeded market forecasts of a 1.6% rise to a seasonally adjusted annual rate of 515,000. Solid job growth, modest home price increases and lower mortgage rates contributed to the unexpected gains in the new home sales.

Higher sales in the housing sector, particularly newly built houses, would further trigger overall economic growth. More and more jobs will be created, particularly in the construction industry, following higher home building activities.

“Rising employment, slowly accelerating wage growth, rising housing demand, slowing home price inflation and mortgage rates at historical lows will underpin greater housing demand and in turn sales through the remainder of the year and into 2016,” said Gregory Daco, head of U.S. Macroeconomics at Oxford Economics.

The August new home sales data was in sharp contrast to the existing home sales that fell more than expected in the month. Existing home sales dropped 4.8%, the National Association of Realtor’s said at the start of the week. Markets had expected home resales of 551,000 last month. However, existing home sales were up 6.2% from the previous year.

Other housing data, including measures of home builder confidence and applications for building permits, were better than forecast estimates, indicating a stronger housing market. A 3% decline in housing starts in August was due to the end of the affordable housing tax credit in New York, rather than weakness in the market.

Home Prices Play a Major Role

New home sales shot up 22% in August from the same period of 2014, with home builders restraining from any major hike in home prices.The median price for a new home grew slightly by $600 from the previous month to $292,700, while the median price for existing homes inched down to $228,700.

Existing home prices were still up 4.7% year over year, however, the rate of increase was at its lowest since August 2014. The point that draws attention is the short supply, which could have been leading to rising home prices. The current inventories of new homes of just 216,000 at the end of August is likely to last for 4.7 months at the current pace of sales. At the current sales pace of existing homes, it would take about 5.2 months to exhaust the existing inventory, down from 5.6% a year ago.

The Optimistic Fed

Last week, the Fed decided to retain the short term interest rates near to zero levels on concerns of a global recession driven by the recent turmoil in China. This could further boost housing sales as mortgage rates would remain at lower levels. The 30-year fixed mortgage rate prevailed at 3.9% last week, which was below historical levels. Lower mortgage rates should help keep home purchases affordable for potential home buyers.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share