Applications for U.S. home mortgages fell last week as interest rates rose to their highest levels since October 2014, an industry group said on Wednesday.

Mortgage applications activity, which includes both refinancing and home purchase demand, decreased 5.5% from one week earlier, according to data from the Mortgage Bankers Association (MBA)’s Weekly Mortgage Applications Survey. On an unadjusted basis, the Index decreased 6% week over week (WoW), the seasonally adjusted Purchase Index decreased 4% WoW, and the unadjusted Purchase Index decreased 6% WoW. It was 15% higher than the same week one year ago.

The Refinance Index decreased 7% WoW and was at its lowest level since January 2015, as rates continued to increase. The refinance share of mortgage activity reduced to 48.5% of total applications from previous week. The adjustable-rate mortgage (ARM) share of activity increased to 6.5% of total applications. This survey covers over 75% of U.S. retail residential mortgage applications, according to MBA.

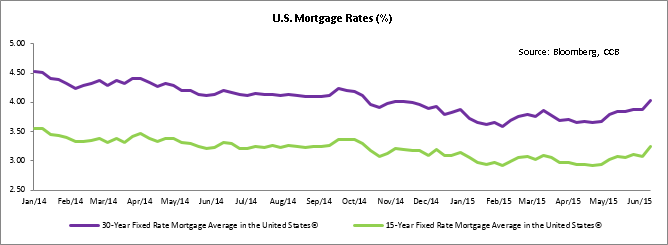

Fixed 30-year mortgage rates averaged 4.22% this week, the highest level since October 2014. They were up 5 basis points from 4.17% the previous week. “Rising rates continue to create volatility in weekly mortgage applications activity. The 10-year Treasury hit 2.5% last week and our survey’s 30-year fixed rate of 4.22% is at its highest level since October 2014. The refinance index dropped to the lowest level since January 2015 as rates continued to increase,” said Mike Fratantoni, the MBA’s chief economist.

U.S. stocks fluctuated, as energy shares increased amid a decline in crude stockpiles and investors awaited a decision on interest rates from the Federal Reserve.

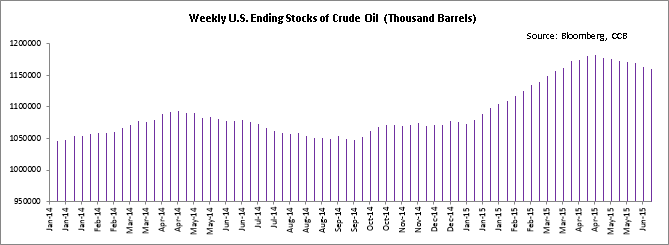

U.S. crude oil inventories fell for a seventh straight week last week. The commercial crude inventories fell by 2.7 million barrels in the week ending June 12 as compared to the prior week’s decline of 6.81 million barrels, the Energy Information Administration said on Wednesday.

Gasoline stocks rose 460,000 barrels but its demand fell by 424,000 barrels during the week. The U.S. benchmark oil futures had been trading as much as $1.16 a barrel above Tuesday’s close in the minutes before the report, but fell quickly after the weekly data release from the U.S. Energy Information Administration at 10:30 a.m. EDT. The front-month July contract was recently down 64 cents, or 1.1%, at $59.33 a barrel on the New York Mercantile Exchange.

“Fundamentals are at an inflection point and will improve from here, with high refinery runs this summer and sequentially declining U.S. crude production. As crude stocks erode, prices will gradually strengthen,” United States-based Pira Energy said.

Today, the Federal Reserve will release its latest monetary policy statement at 2:00 p.m. ET, along with an updated outlook for the economy, all of which will be followed by a press conference from Fed chair Janet Yellen at 2:30 p.m. Expectations are that the Fed will keep its benchmark interest rate unchanged at 0%-0.25%, but many expect the Fed will lay further groundwork for a rate hike as soon as September, in a meeting that will take place exactly 3 months from today.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share