** DRAFT - NOT PUBLICALLY VISIBLE **

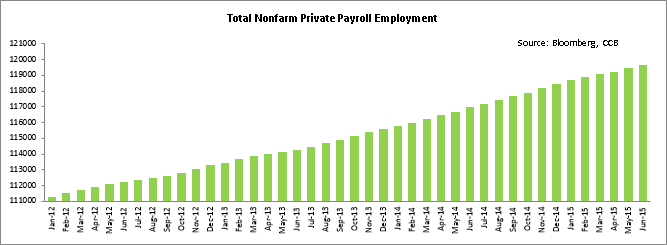

A solid job report from payroll processor Automatic Data Processing Inc. (ADP) on Wednesday added to the evidence of a strengthening U.S. economic outlook. In June, the private sector added about 237,000 jobs, according to the ADP nonfarm employment report.

The gain in June employment marked the biggest gain since December 2014. It exceeded the market expectations of 218,000 new jobs and the revised 203,000 jobs in May, which was the smallest rise since January 2013. The ADP employment levels have been consistently above 150,000 since January 2013.

The ADP report comes ahead of the monthly nonfarm payroll report from the U.S. government’s Bureau of Labor Statistics. This report includes both government and private sector jobs. Economic reports culminate with Thursday’s release of the June employment report. Nonfarm payrolls are expected to increase by 230,000 in June, down from 280,000 in May, according to economists surveyed by The Wall Street Journal.

The June ADP report clearly shows that the U.S. labor market is trending higher, which triggers overall economic growth. Such job gains should boost Fed confidence to increase short-term interest rates in September.

A larger portion of the June private employment gains came from small and medium-sized employers. The service-providing industries have created about 225,000 jobs in June, while goods-producing industries added a modest 12,000 jobs.

The construction industry is getting back in shape with a second month of increase, adding 19,000 jobs in June. The manufacturing industry added 7,000 jobs in June after slashing jobs in the previous month.

The construction industry is gaining strength with increasing sales of new and existing homes, with higher demand from first-time home buyers. In terms of business size, large businesses with 500 or more employees added 32,000 jobs, while medium-sized businesses added 86,000 jobs. Small businesses with less than 50 employees added 120,000 jobs.

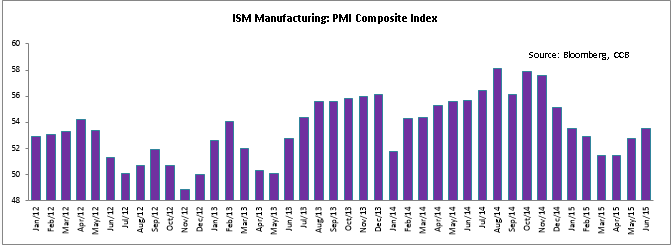

A similar uptrend was witnessed in the U.S. manufacturing activities. The June ISM manufacturing PMI came in at 53.5, beating the market expectations of 53.1. The June ISM Manufacturing PMI was the highest since January 2015, triggered by stronger job gains and a better order book position.

Employment grew at a faster pace than new orders and production. A 3.8 point increase in the Employment Index to 55.5, from May’s reading of 51.7, primarily drove the gain in the Headline Index. Demand improved in Wood Products, Furniture and Related Products, Non-Metallic Mineral Products, Paper Products, Computer & Electronic Products, and Transportation Equipment.

On the other hand, Primary Metals, Petroleum and Coal Products, Electrical Equipment, Appliances and Components, and Plastics and Rubber Products declined in June. The New Orders Index, Production Index, and Inventories of Raw Material Index grew by 0.2, 0.5 and 1.5 points to 56, 54 and 53 in June. However, the Prices Paid Index remained unchanged at 49.5 from May, indicating lower raw materials prices for the eighth consecutive month.

Prices of eggs remained high due to a short supply on the back of the Avian Flu outbreak, partially offset by lower prices of aluminium, oil and gas, and steel related products. An upbeat June ISM manufacturing report is in sharp contrast to the weak manufacturing reading of U.S. Market Survey released last week.

Meanwhile, the U.S. American Petroleum Institute (API) weekly crude stocks, which serve as a preview to the U.S. Energy Information Administration (EIA) weekly crude oil stockpile report, rose unexpectedly last week, as per the official data released on Tuesday. The U.S. API Weekly Crude Stock rose to 1.900 mn barrels for the week ending June 26, 2015 from -3.200 mn barrels in the preceding week. The market had expected the U.S. API Weekly Crude Stock to fall -1.300 mn barrels last week. The EIA oil stocks fell by 4.9 Mn barrels to 463 Mn barrels for the week ending June 19, 2015.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share