** DRAFT - NOT PUBLICALLY VISIBLE **

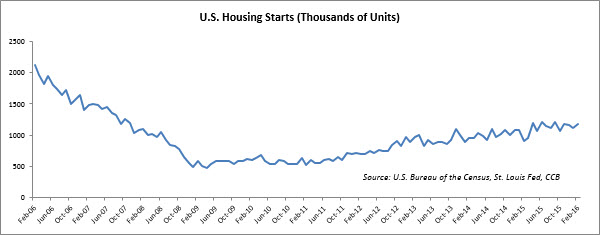

Home building in the U.S. rose more than expected in February, due to an increase in the construction of single-family homes.

In February, housing starts climbed 5.2% month-over-month to an annualized rate of 1.18 mn, reaching their highest level since September and beating economists' expectations of 1.15 mn. February's pace marked a 30.9% increase over housing starts rate a year ago, when demand and construction both slowed due to unfavorable weather and tight credit conditions. January's figures were revised up to a 1.12 mn rate from the previously reported 1.099 mn.

Ground-breakings were up in almost all regions of the country. Housing starts increased 19.9% in the Midwest, 7.1% in the South, and 26.6% in the West; however they tumbled 51.3% in the Northeast. Most likely, the housing industry benefited from the mild winter weather, which is ideal for construction. Four states in the Northeast reported higher than average precipitation in February, which may have led to a decline in construction in that region.

Compared to the previous month, multifamily units increased 0.8% to 356,000 in February. Single family homes (which account for two-thirds of the market) rose 7.2% to 822,000, marking their highest level since November 2007.

On a year-over-year basis, single-family buildings rose by as much as 37%. On the other hand, starts for multi-family homes increased by just 16.8% – that's less than half of the gain displayed by single-family construction. According to Gus Faucher, Senior Macroeconomist at PNC Bank, "Multi-family housing has probably peaked." Single-family homes are considered to be a better indicator of overall economic growth, so this may be a positive indicator.

The latest data shows continued builder confidence in demand for residential real estate and is expected to lift first-quarter gross domestic product growth estimates (which were reduced in the wake of a weak February retail sales report). Of late, employment growth has been steady and layoffs have stayed at low levels, which may have been instrumental in luring more buyers to the residential market.

Nevertheless, shortages of land and labor have caused delays in the completion of many projects, and this could lead to an increase in housing prices. According to Harm Bandholz, chief U.S. economist at UniCredit Bank AG, "We still have a lack of supply in the market, and that's of course good news because that will continue to drive prices and construction activity higher."

Meanwhile, building permits in February declined 3.1% to an annualized rate of 1.17 mn from a revised January rate of 1.204 mn. Economists had expected them to be little changed and remain within a range of 1.14 mn to 1.25 mn. Though the level was up 6.3% year-over year, the trend has been mostly flat over the past three months.

Permitting is a key indicator for future construction. On a regional basis, it fell everywhere but the Northeast, suggesting limited additional gains in the coming few months. In the Midwest, building permits decreased by 11.4%, in the South by 4.4%, and in the West by 7.2%. In the Northeast however, permitting showed a 40.4% increase.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share