** DRAFT - NOT PUBLICALLY VISIBLE **

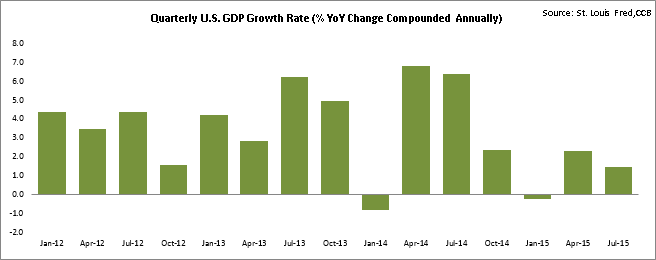

The enthusiasm of the solid second quarter growth in the U.S. economy dissipated with a sharp slump in the third quarter growth rate.

The Gross Domestic Product (GDP) expanded at a modest 1.5% annual rate in the third quarter of 2015, far below the 3.9% increase in the second quarter. Economic growth remained sluggish (0.6%) in the first quarter due to harsh winter weather and the U.S. West Coast port disruptions that stalled business activities. The GDP, however, rebounded in the April-June quarter with better consumer spending, but fell again in the third quarter led by inventory cutbacks, wider trade deficits and lower business investments.

However, we are still anticipating a December Fed rate hike as domestic demand remains encouraging. Economic growth should pick up in the fourth quarter driven by strong domestic fundamentals.

What to Blame?

Business inventories nearly halved from the previous quarter’s $113.5bn to $56.8bn in the third quarter and were the lowest since the first quarter of 2014. The smaller increase in inventories led to a 1.44% fall in the third-quarter GDP growth, the largest since the fourth quarter of 2012.

A 46.9% decline in business investment in the mining industry led to a 4% fall in investments on non residential structures. In addition to lower inventories and lower business spending, a wider trade deficit also hampered the overall growth in the economy. U.S. manufacturers are battling with a stronger currency that is holding back exports in key markets by making products less competitive in foreign markets.

However, the fall in inventories should be temporary as consumers still look bullish. Consumer spending is rising, buoyed by a fall in gasoline prices and strengthening labor markets. Consumers spent about 3.2% more in the third quarter, against a 3.6% rise in the second quarter.

Is the Housing Recovery Stumbling?

The fall in the economic growth was accompanied by softening pending home sales. The Pending Home Sales Index, a leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos and co-ops.

According to the National Association of Realtors (NAR), the Index dropped 2.3%, to 106.8 in September, the second lowest in 2015. The Index was up 3% in the same period last year. Contracts to buy previously owned houses were expected to rise 1%. Pending home contracts fell in all four regions in September, with a more pronounced 4.0% fall in the Northeast. Still, contracts in all regions remain above their levels from a year ago.

“There continues to be a dearth of available listings in the lower end of the market for first-time buyers, and realtors in many areas are reporting stronger competition than what’s normal this time of year because of stubbornly low inventory conditions,” stated Lawrence Yun, NAR chief economist. “Additionally, the rockiness in the financial markets at the end of the summer, and signs of a slowing U.S. economy, may be causing some prospective buyers to take a wait-and-see approach,” added Yun.

The Federal Reserve believes the economy will show strength in the near future. For the full 2015, the economy is expected to expand about 2.3%, close to last year’s 2.4%. Although contract activities have declined from the more robust levels seen earlier this year, the housing market will still likely be one of the brighter spots in the U.S. economy in coming months.

“With interest rates hovering around 4%, rents rising at a near 8-year high, and job growth holding strong — albeit at a more modest pace than earlier this year — the overall demand for buying should stay at a healthy level despite some weakness in the overall economy,” said Yun.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share