** DRAFT - NOT PUBLICALLY VISIBLE **

The world’s largest economy will see more construction activity in the future as suggested by a steady rise in investment in the sector that has helped the growth of the overall economy.

The U.S manufacturing sector has been a major let-down, hurt by an appreciating dollar and slower growth in overseas business. Although a short supply of homes is hampering demand, historically low mortgage rates and steady employment gains should help strengthen the market.

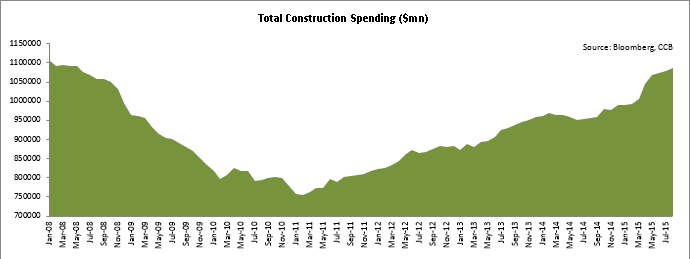

August construction spending climbed to the highest level since 2008, after it touched its seven year high in July, driven by a surge in outlays for residential projects. Construction spending gained 0.7% versus expectations of 0.5% to $1.09 tn, the highest level since May 2008, the Commerce Department reported last week.

The increase in spending was buoyed by a 1.3% rise in private residential construction spending to the highest level since January 2008. Spending on private non-residential construction projects rose 0.2%, hitting its highest level since November 2008. Public construction expenditure rose 0.5%.

On the flipside, the pace of growth in the U.S. manufacturing sector slowed further in September and remained at its lowest level since May 2013. The Institute for Supply Management’s Index of national factory activity of 50.2 in September was only slightly above the benchmark level of 50 that indicates expansion.

Solid Yearly Gains for Pending Home Sales

Pending sales are considered a leading indicator of the health of the housing industry, as they track new purchase contracts. Existing-home sales are recorded when a deal closes, which is usually a month or two later. Although the Pending Home Sales Index fell 1.04% to 109.4 in August from 110.9 in July, it was up by a strong 6.1% from the previous year. The slight decline in sales is led by lower housing inventories.

The housing industry has been battling a lack of home supply, pushing home prices up. Rising home prices and supply constraints are weighing on home sales as they lessen the number of homes available within the budgets of potential home buyers. Moreover, the volatility in global markets has induced pessimism among home buyers, who are becoming extra cautious when making a home purchase.

“Pending sales have leveled off since mid-summer, with buyers being bounded by rising prices and few available and affordable properties within their budget,” said Lawrence Yun, NAR Chief Economist.

Regionally, pending home sales in the Northeast, Midwest and South fell by 5.60%, 0.40%, and 2.20%, respectively, in August 2015. However, sales in the West grew 1.8%, somewhat mitigating the declines in the other regions.

Consumer Confidence & Optimism Flat in the Short-Term

Meanwhile, Consumers in U.S. are wary of the downturn in China, which might have an impact on global economies. Hence they do not expect accelerated economic growth in the coming months. This concern led to a modest growth in consumer confidence in September. The Conference Board’s Consumer Confidence Index inched up to 103 in September from the previous month’s reading of 101.3, above market estimates of 96.1.

“Consumer confidence increased moderately in September, following August’s sharp rebound,” said Lynn Franco, Director of Economic Indicators at The Conference Board.

Consumer confidence was boosted by a better appraisal of the labor market in the last month. Consumers who said business conditions are “good” were up 23.7% to 28.0%, while those claiming business conditions are “bad” declined modestly from 17.8% to 16.7%. The percentage of consumers expecting business conditions to improve in the upcoming six months expanded from 16.6% to 17.9%, but those expecting business conditions to worsen also increased, from 9.1% to 10.3%.

Consumer confidence should get a boost from the Fed’s decision to maintain the interest term rate at the same level, and home buying could see an uptick in the coming months. The European Central Bank has also retained interest rates at the same level to revive economic growth in European economies and boost consumer sentiment.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share