** DRAFT - NOT PUBLICALLY VISIBLE **

Exports in the world's second largest economy, China, fell for a third consecutive month in May, despite strong stimulus measures by the government and the Central Bank to boost growth. However, exports to the U.S. rose 7.8% Year-over-Year (YoY) and formed about 18.8% of the total Chinese exports in May, the highest share since August 2010. U.S. consumers appear to be the biggest body of spendthrifts in the world, and helped China to prevent a deeper decline in shipments abroad. As per the China Customs Statistics (CCS), China recorded a trade surplus of about $24.2 bn against the U.S. in May. China’s exports to the U.S. includes electrical and machinery goods, furniture, toys, textiles and garments.

U.S. job growth accelerated sharply in May and wages picked up. These are signs of strong momentum in the economy and bolster prospects for Chinese goods. About 280,000 jobs were added in May, which was above the market expectations of 225,000. Wages jumped 2.3% YoY and 0.3% Month-over-Month (MoM), the largest rise since August 2013. Economists forecasted wages rising 0.2% in May. Wages are set to rise higher owing to a firming demand for entry-level workers and improving composition of jobs that are being created. Greece’s decision to delay a crucial loan repayment to the International Monetary Fund due on Friday was another factor that contributed to the strength of the USD. For the first time in five years, Greece deferred IMF payment, requesting instead to bundle the four payments due to the lender this month, totaling 1.6 billion Euros, into a single payment to be made on June 30.

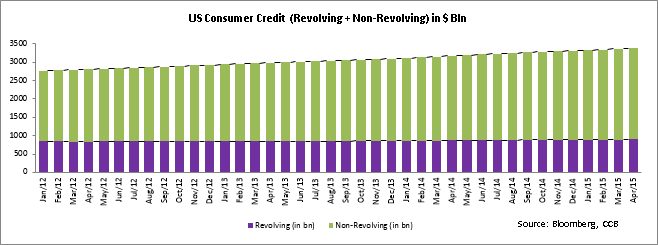

The recent rise in jobs and wages triggered a rise in consumer spending and consumer credit, which is vital to boost consumer consumption in the economy. Consumer credit increased for the second time in April on higher credit card borrowings. Credit card borrowings touched its highest level in a year during April, after a slump in the first quarter (Q1) of heavy job losses made consumers cautious to add more debt.

Harsh weather conditions and the strength of the US dollar hurt exports and added to miserable consumer loans in Q1. Consumer borrowing increased by $20.5 bn or 7.3% YoY to record high of $3.38 tn in April, the Federal Reserve said on Friday. The increase was slightly below the $21.3 bn rise in March – which was the biggest gain in eight months.

The increase in consumer credit was driven by 11.6% or an $8.6bn jump in credit card borrowings/revolving credit to $900bn. Non-revolving credit, including auto and student loans, climbed $11.9bn or 5.8% to $2.4tn in April following a $16.5bn rise in March. On a YoY basis, consumer borrowings in the US increased 6.6%, helped by a 3.2% rise in credit card spending. Auto and student loans improved by 7.9%.

An improving job market and wages should help the US economy grow at a consistently better rate. A lower than expected Gross Domestic Product rate of 0.7% in Q1 should rebound from 2% to 2.5% in the second quarter, helped by stronger consumer spending.

As of April, the Federal Government continues to be the largest holder of non-revolving credit, holding 36% of outstanding credit followed by finance companies and depository institutions that holds near to 25% each of the total non-revolving credit. Depository institutions are the largest holder of revolving credit, holding 82%.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share