** DRAFT - NOT PUBLICALLY VISIBLE **

The long discussed Fed short term interest rate hike will be the next week’s focus. Fed officials will meet on Wednesday to decide on the interest rate hike due this year.

Strong labor market and retail sales reports, coupled with a solid rise in the Producer Price Index, were the latest indications that the economy is gaining momentum after a sluggish start to the second quarter.

Consumer sentiment was upbeat despite higher gasoline prices, which led to producer prices posting their biggest rise in more than two and a half years in May. Consumer confidence in the U.S. surged in early June on expectations that a tightening labor market would spur a wage hike, which may further stimulate spending and overall economic growth later this year.

NY Empire State Manufacturing Index (Mon): The Empire State General Business Conditions Index is expected to jump to 6 in June from 3.09 in May, with improving manufacturing activities at U.S. factories. Growth in manufacturing activities accelerated in May after declining for three consecutive months. New orders came in at a higher pace. The New Orders index returned to positive territory to 3.85 in May, from -6.0 in April, the weakest since January 2013.

Industrial Production (Mon): The May industrial production data released by the U.S. Federal Reserve is expected to have increased 0.3%, against a similar drop in April. The slump in the oil and gas industry has led to low industrial production. Oil and gas drilling activities have nose-dived since oil prices plunged in the middle of 2014. Oil and gas drilling is expected to remain weak, impacting industrial production.

NAHB Housing Market Index (Mon): The National Association of Home Builders will release its Housing Market Index, a gauge of builder confidence for the month of June. The Index is expected to climb to 56 in June from 54 in May. If the Index comes as per expectations, it will be the first time in nine years it rose above 50 for one full year. A reading above 50 indicates that the builders have been confident about housing in each of the last 12 months.

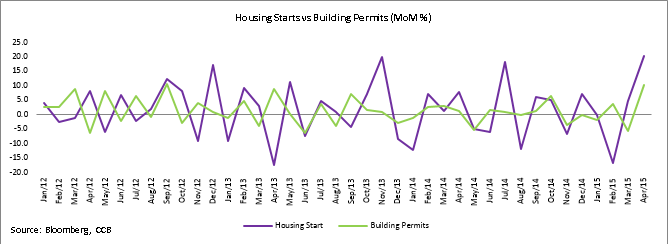

Building Permits (Tues): Building permits for May are estimated to grow about 3%, 1.1mn Month-over-Month (MoM) in May following a 10% MoM rise in April to 1.143 mn. An increase in building permits ensures a healthy real estate supply going forward. With the U.S. economy gaining momentum, the uptrend in building permits is expected to continue in the longer term.

Housing Starts (Tues): The Department of Commerce will release May housing starts data on Tuesday. Housing Starts are expected to rise a little over 3% MoM to 1.1mn in May after a robust 20.2% MoM gain in April to 1.1.35mn. The rise in April starts was the highest since late 2007. Rising wage rate and a stronger job market should accelerate growth in housing starts.

Fed Interest Rate Decision (Wed): The Fed officials are scheduled to meet on Wednesday to discuss the possibility of a rate increase. Stronger consumer confidence, a tightening labor market, buoyant retail sales and rising inflation pressures induce optimism on the U.S. economic outlook. Although the recent economic data indicates a turnaround in the second quarter, the Fed remains sceptical with the first quarter slump. Probabilities are high that the initial June rate hike will be ruled out. The Fed has kept its benchmark overnight lending rate near to zero since December 2008.

Consumer Price Index (CPI) (Thurs): The Department of Labor is scheduled to release the May consumer-price index data on Thursday. With the recent uptick in oil prices, we expect a large 0.5% gain in the May CPI from a 0.1% rise in April. Falling energy prices weighed down on the CPI until last month. Yet, consumer prices remain low reckoned Year-over-Year (YoY).

Core Consumer Price Index (CPI) (Thurs): Inflation remains soft even when volatile food and energy prices are excluded. The Core CPI is expected to gain 0.2% MoM, slightly down from last month’s gain of 0.3% MoM. The Fed has targeted core inflation of 2% YoY before any interest rate hike. The Core CPI is expected to remain flat at 1.8% YoY.

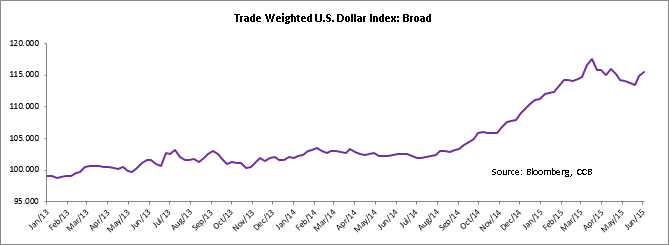

Current Account (Thurs): The U.S. current account deficit is expected to rise to $116.8bn in 1Q15 from a deficit of $113.4bn in 4Q14 and 98.9 bn in 3Q14. An appreciating U.S. dollar has hurt the U.S. export businesses and made imports attractive, which led to a rising current account deficit. The strong jobs report sent the U.S. government bond yields surging as wage increase indicates inflation is pushing toward the Fed’s target and led to an a rising dollar. Greece’s decision to delay a crucial loan repayment to the International Monetary Fund was another factor that contributed to the strength of the dollar.

Philadelphia Fed Manufacturing Index (Thurs): The Philadelphia Fed Manufacturing Index is expected to climb to 8.0 in June with an improving labor market and a gain in Producer Prices Index. In May, the Index declined to 6.70 from 7.50 in April. The fall in April was against the consensus expectations of a rise to 8.1. The Index has remained in a single-digit range for the first five months of this year.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share