** DRAFT - NOT PUBLICALLY VISIBLE **

MARKET TRENDS: Strong Jobs Growth Report Increases Expectations of September Rate Hike

June 5, 2015

June 5, 2015

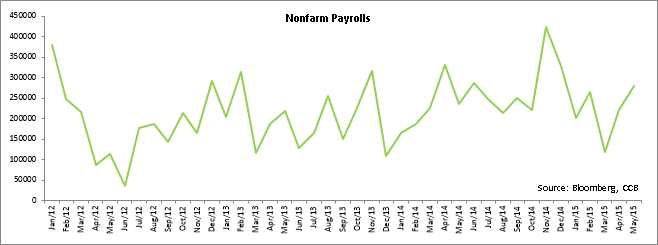

U.S. job growth accelerated sharply in May with Nonfarm Payrolls showing an increase of 280,000, more than economists’ expectations of a gain of 225,000 positions. The data, which shows the largest gain since December, indicates that most likely growth is back on track after a slow start to the year and bolsters prospects for a rate hike in September. The upbeat Payroll numbers lifted job growth above last year’s average of 260,000 jobs per month. The services industry added the most positions in May, showing an increase of 63,000, while leisure and hospitality grew by 57,000. Healthcare grew by 47,000, retail by 31,000 and construction moved higher by 17,000. Manufacturing employment increased 7,000 after adding 1,000 jobs in April. The mining sector was a dark spot that reduced workers by 17,000 as it worked through the cuts announced by oil-field companies, bringing the decline to 68,000 in 2015. Previous months showed minor changes, with March’s disappointing count getting pushed higher to 119,000 from 85,000 and April edging lower from 223,000 to 221,000.

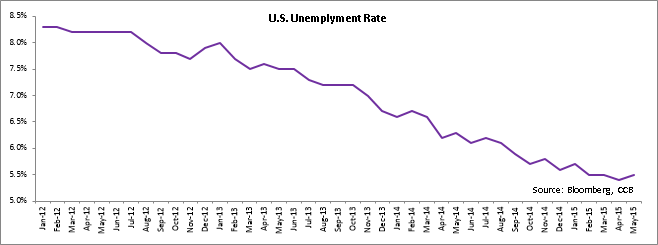

Meanwhile, the unemployment rate, which is obtained from a separate survey of U.S. households, was 5.5% in May, up slightly from 5.4% the month prior. Economists had expected the employment rate to hold steady at 5.4%. The increase is attributed to one good reason: more people looked for work last month, suggesting Americans are more confident about their job prospects. The number of discouraged workers – people who were not looking for work because they believed no jobs were available for them – dropped sharply compared with a year ago, to 563,000 from 697,000 in May 2014. Compared to April, the labor force participation rate ticked higher by 0.1% to 62.9%. A separate measure that counts those working part time for economic reasons, and the unemployed who have not looked for work in the past month, held steady at 10.8%.

Wages also showed growth, rising 8 cents an hour, equating to an annualized increase of 2.3% and a monthly increase of 0.3%. This is the largest increase since August 2013. Economists had expected a 0.2% increase in wages from April. Wages are set to rise higher owing to a firming demand for entry-level workers and a better composition of jobs that are being created. Walmart, the largest private employer in the United States, announced this week it would raise minimum wages for more than 100,000 U.S. workers. This is its second wage hike in 2015. Many states have raised their minimum wages as well.

The average work week was steady at 34.5 hours. The strong jobs report sent the U.S. government bond yields surging as the wage increase indicates inflation is pushing toward the Fed’s target and led the USD to rally against a basket of currencies. Greece’s decision to delay a crucial loan repayment to the International Monetary Fund due on Friday was another factor that contributed to the strength of the USD. For the first time in five years, Greece has postponed a payment to the IMF, requesting instead to bundle the four payments due to the lender this month, totaling 1.6 billion Euros, into a single payment to be made on June 30.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share