** DRAFT - NOT PUBLICALLY VISIBLE **

MARKET TRENDS: Stock Market Volatility Weighs On U.S. Small Business Optimism

October 20, 2015

October 20, 2015

The recent volatility in the U.S. stock market triggered waves of despair among small business owners in the country.

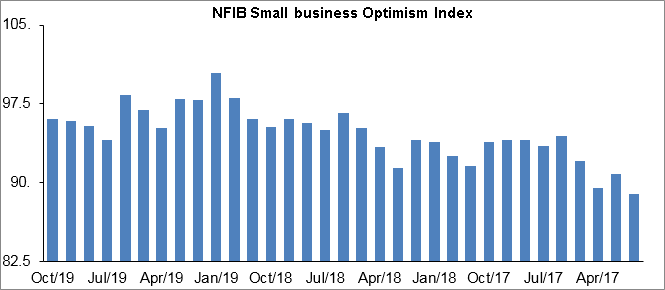

Small business confidence remained shaky and reflected modest growth in September, after rebounding from its 15-month low in July this year. According to the National Federation of Independent Business (NFIB), the Small Business Optimism Index increased by a marginal 0.2 points to 96.1 in September 2015, compared to 95.9 in August. The Index remains well below its 42-year average of 98, suggesting moderate expansions in the World’s largest economy.

“Financial markets did not provide any encouragement to owners, instead providing volatility that only a trader could like, and this produces uncertainty,” said the NFIB in its latest release. The majority of the small businesses that participated in the survey were from the Retail, Construction and Manufacturing sectors.

Source: NFIB, CCB

The monthly measure of confidence among small business owners, however, was above market expectations of 95.5 in September, on hopes of better economic conditions and increases in capital expenditure and inventories. While a small business does not influence the overall economic growth, collectively they are the most impacted in an economic downturn due to their size.

“Small business optimism continues to be stagnant, which is consistent with the expected economic growth of about 2.5%,” stated Bill Dunkelberg, NFIB’s chief economist.

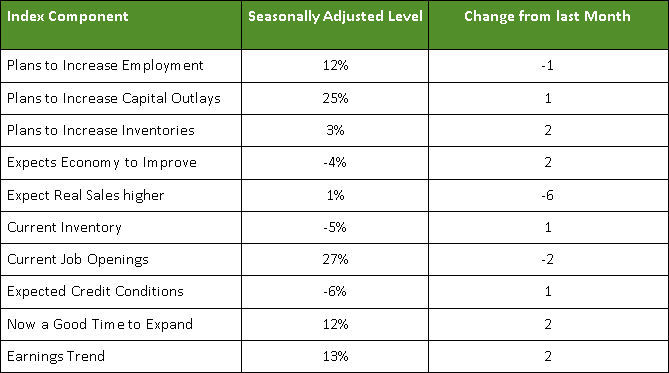

Source: NFIB, CCB

Out of the ten components of the headline Index, seven eked out gains, while three fell. Hiring activities improved as owners added a net 0.18 workers per firm in recent months, the highest level of the year.

Labor market indicators have remained at historically strong levels. About 142,000 new jobs were added in September, following an increase of 136,000 positions in August. A full 53% of owners reported hiring or trying to hire, while 45% reported few or no qualified applicants for the positions they were trying to fill.

“The percentage of owners citing the difficulty of finding qualified workers as their most important business problem increased and is now third on the list behind taxes and regulations,” added Dunkelberg.

Capital spending remained unchanged in September. About 58% of businesses reported capital outlays, while 25% of owners are planning capital outlays in the next 3 to 6 months. This is up 1% from August’s reading, as owners expect a continuation of economic “under-performance.”

The earnings trends index improved 2 points in September, as the net portion of owners reporting hiring earnings improved to a negative 13%, a 6-point increase from July. Negative earning trends improved as lower fuel prices led to cost inflation at lower levels.

Credit conditions were satisfactory for small business owners. Only 2% reported that all their borrowing needs were not met – a record low.

Although small business owners were concerned about sales growth, they were confident about business conditions over the next six months and believed it was a good time to expand. About 12% of businesses plan to create new job opportunities, and 25% plan to undertake capital spending initiatives in September. Yet, the second half of the year 2015 is not expected to see any dramatic growth with an unimpressive July, August and September.

“The small business sector will keep plodding forward with little risk of recession at the expense of a potential boom.” stated Dunkelberg.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share