** DRAFT - NOT PUBLICALLY VISIBLE **

MARKET TRENDS: Solid Housing Starts and Builder Confidence Hints at Possible Fed Rate Hike

November 16, 2015

November 16, 2015

Looks like the U.S. housing industry has finally landed on solid ground, with a sixth consecutive increase in housing starts in September.

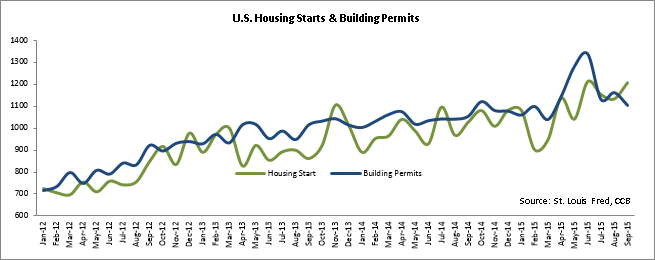

Housing starts rose 6.5% to a 1.21M annualized in September after touching its second highest level in the past eight years in July. Soaring demand for rental apartments, especially from the younger population who cannot afford to buy homes due to higher prices and related debt, led to the gains in starts.

“The trend in housing should remain relatively strong,” said Thomas Costerg, a senior U.S. economist at Standard Chartered Bank in New York.

Economists say sturdy domestic demand and firming housing strengthen the argument for the Federal Reserve to raise interest rates this year.

“But the Fed seems to be using binoculars to look at the economy, as it is the rest of the world, not just domestic demand, that seems to be the focus of attention,” said Joel Naroff, chief economist at Naroff Economic Advisors.

Housing starts were expected to range between 1.09M and 1.2M in September, up from August’s 1.13, which was a slight change from the prior estimates. According to a release by the Department of Commerce, apartment buildings rose 18.3% to a 466,000 pace, while construction of single-family houses grew modestly 0.3% to a 740,000 rate. Year-to-date, housing starts are up 12%.

Regionally, starts in the South rose 0.6% to their highest level since October 2007. In the West, ground-breaking on housing projects jumped 24% – the highest since July 2007. Construction declined 12.2% in the Midwest, the biggest drop since February.

Home building rebounded in September following two consecutive declines. New-home construction in the U.S., particularly construction of apartments and other multifamily housing, climbed in September. An improving job market, coupled with lower mortgage rates, have led to an increase in demand for homes.

U.S. home builders have become optimistic and are busy constructing new homes. An index of home builder confidence released earlier this week by the National Association of Home Builders rose to its 10-year high of 64 in October with, builders upbeat about current sales conditions and expectations over the next six months.

Building Permits Fall Temporarily

Building permits fell 5% between August and September to a seasonally adjusted annual rate of 1.1M, its six month lowest. Permits for single-family buildings declined 0.3% last month, while multi-family building permits slipped 12.1%. Permits for buildings with five units or more fell to their lowest level since December 2014. The drop in permits seems to be temporary given the strong confidence levels among home builders. Building permits are up 13% year-over-year. Permits for single-family homes in the South rose to their highest level since January 2008.

Home Resale Rise

Better job growth, improving demand and lower mortgage rates led to the highest existing home sales since February 2007 in September, which further confirmed the strengthening U.S. housing market. Sales of previously owned homes climbed 4.7% last month to a seasonally adjusted annual rate of 5.55M, slightly below the post-recession high touched in July.

At the current sales rate, existing home inventory was at a 4.8-month supply, down from 5.1 months in August and 5.4 months a year ago. “As we enter softer demand months, we may not really feel the squeeze of tight inventory, but come spring of next year … we could be facing a very tight inventory situation,” said Lawrence Yun, the NAR’s chief economist.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share