** DRAFT - NOT PUBLICALLY VISIBLE **

MARKET TRENDS: Retail Sales, Business Inventory Beat Estimates; Jobless Claims Below 300,000

June 11, 2015

June 11, 2015

U.S. retail sales surged in May after a slow start in the second quarter, a sign economic growth is finally gathering steam. A solid job growth rate and improving wage rate boosted consumer confidence, which was reflected in household spending.

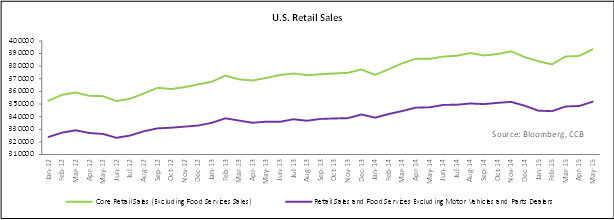

Sales of automobiles and a range of other goods increased. Overall retail sales for May advanced 1.2% Month-over-Month (MoM) to $444.9 bn, up from a revised 0.2% rise in April, the Commerce Department said on Thursday. The gain in May sales was slightly higher than the consensus estimate of a 1.1% rise.

Total retail sales climbed 2.7% Year-over-Year (YoY). Core retail sales, which remained flat in April, improved 1% MoM in May, higher than the forecasted 0.7% increase. Retail sales excluding automobiles, gasoline, building materials and food services inched up 0.7% in May following a revised 0.1% rise in April.

The rise in total sales was buoyed by a 2.1% increase in auto sales, while gasoline sales reached its highest level by growing 3.7% MoM on rising oil prices. Electronic and appliance sales were up 0.1%, while furniture sales increased 0.8%.

Sales at clothing and clothing accessories stores moved up 1.5%. Online sales increased 1.4%, and sales at sporting goods stores inched up 0.8%. Sales of building materials and garden equipment jumped 2.1%.

Consumer spending is likely to remain strong in the near term on a strong labor market and an improving income level. The Fed is close to meeting its objectives of a stronger job market and core inflation rate of 2%. The better than expected retail sales data has further increased the prospects of a Fed rate hike in September.

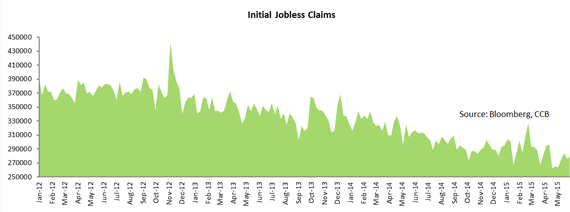

Another government report stated that applications for unemployment benefits edged up 2,000 to 279,000 in the week ended June 5, above market expectations of 277,000. However, the initial jobless claims were still below the 300,000 mark for the 14th week in a row, indicating a tightening labor market. The four-week moving average of the initial jobless claims, which is considered as a better indicator of the labor market trends, advanced to 278,750 from 275,000 last week.

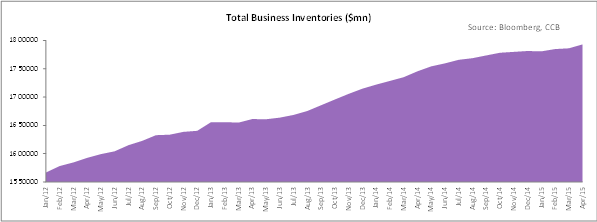

The U.S. business inventories, which include stock with the manufacturers, wholesalers and retailers, in April posted the highest gain since May 2014. Inventories climbed 0.4% MoM to $1,793.2 bn, the Commerce Department said on Thursday.

The gain in inventory was higher than last month’s 0.1% increase, and better than the market expectations of +0.2%. Business inventories were up 2.6% YoY.

Inventories, particularly the retail excluding autos, form a part of the Gross Domestic Product (GDP). April retail inventories excluding auto were up 0.6% MoM, the biggest rise since November 2013.

Retail inventories rose by a 0.1% in March. The GDP, which contracted 0.7% in 1Q15, is likely to improve in 2Q15 with stronger retail sales, better healthcare and construction spending (reported on Wednesday) and higher trade and wholesale inventory data.

Business sales rose by 0.6% in April following a similar rise in March. Going by the inventory-to-sales ratio, it will take 1.36 months to convert the stock into sales. A higher inventory turnover ratio will restrict businesses to aggressively accumulate stocks. The ratio was unchanged from March.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share