** DRAFT - NOT PUBLICALLY VISIBLE **

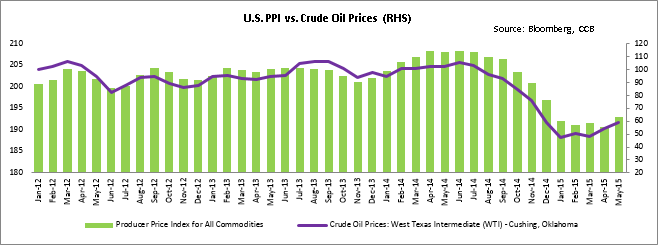

The Producer Price Index (PPI), a percentage of change in the prices of finished goods and services sold by producers in the U.S, posted its biggest gains in May in over two and a half years. The gains were primarily driven by the higher cost of gasoline and food products. The PPI for final demand increased 0.5% Month-over-Month (MoM), the Labor Department said on Friday.

The rise in PPI exceeded market expectations of a 0.4% increase, and was the largest gain since September 2012. In April, the Index had declined 0.4% MoM, driven by lower oil prices.

Excluding food and energy, Core PPI, a key measure of producer price pressures, edged up 0.1% vs. a 0.2% slip in April, and was in line with expectations. Excluding food, energy and trade services, PPI slipped 0.1% in May, after a similar rise in April.

The prices of goods have remained consistent for most of 2014, and declined later on with plunging energy prices. On a year-over-year (YoY) basis, PPI was down for the fourth straight month by 1.1%, while Core PPI gained 0.6% vs. 0.7% expectations.

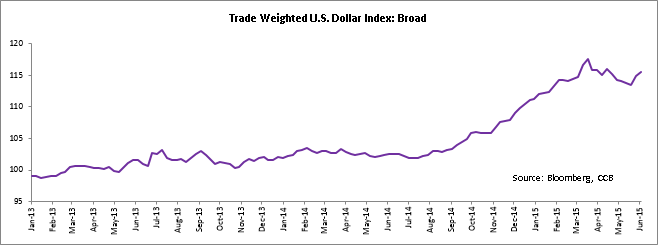

A sharp decline in crude oil prices since 2014, coupled with a strong dollar, have put pressure on producer prices. However, a recent uptick in oil prices eased off some stress on inflation.

Gasoline prices shot up 17% in May, the largest increase since August 2009. Crude oil prices touched $100 per barrel in the middle of 2014, but tumbled below $50 at the start of the 2015. Prices have now firmed near $60 per barrel, and producer prices are expected to pick up gradually with the rising dollar rates.

May food prices broke through the negative territory and gained 0.8%, the biggest rise in the last year, after declining for five straight months. Higher food prices were driven by a short supply of eggs after an outbreak of Avian Influenza in the United States. As a result, egg prices increased by a record 56.4% in May.

The Trade Services component of the headline index, which indicates profit margins at retailers and wholesalers, inched up 0.6% in May, following a drop of 0.8% in the previous month. The increase in the Trade Services Index reflects improving profit margins at service stations, which had been pressured by falling gasoline prices.

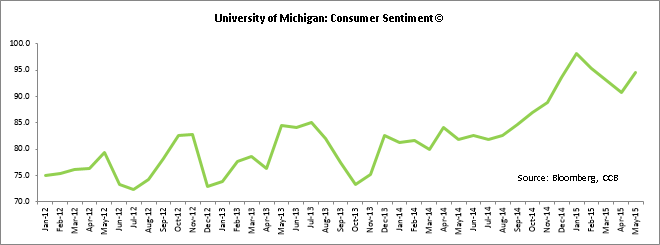

Consumer confidence gained more than expected in May as households foresee a strengthening U.S. economy. The preliminary reading of the University of Michigan’s Consumer Sentiment Index, a leading indicator of consumer spending, jumped to 94.6 and marked the first increase in the last three months.

The rise in Index was well above market expectations of 91.2 and last month’s 90.7. The Index has exhibited consistent improvement after touching a yearly low of 79.2 in August, 2014.

The higher than expected rise in the headline index was largely helped by an improvement in the assessment of current conditions. The Current Economic Conditions Index climbed to 106.8 in June from 100.8 in May. The Consumer Expectation Index also moved up to 86.8 from 84.2.

The uptrend raise hopes of a stronger consumption growth for the rest of the year. The upbeat May retail sales report on Thursday added expectations of a better consumer spending in the second half of 2015. The stabilization in producer prices, and a higher consumer confidence, supports the Federal Reserve’s planned interest rate hike this year.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share