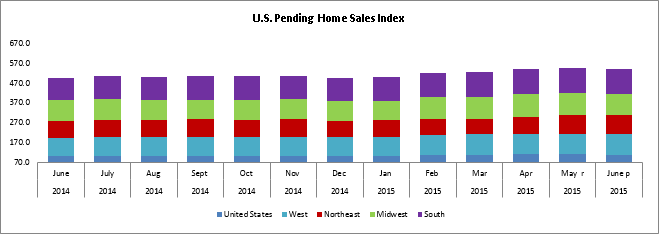

Pending home sales faltered in June after gaining for the last five consecutive months. Signed contracts to buy existing homes that hit a 9-year high in May, fell to their lowest since March. The Pending Home Sales Index, a leading indicator of the housing market which measures housing contract activity, unexpectedly slipped 1.8% to 110.3 in June, the National Association of Realtors said on Wednesday. Pending home contracts become sales after a month or two, and last month’s drop pointed to a pause in existing home sales. The drop in pending home sales was in contrast to the market expectations of a rise of 1.0%. Yet, the June reading was the third highest in this year. On a yearly basis, pending home sales were up 8.2%.

Rising home prices have dragged down housing sales. The U.S. home prices have been rising due to lower housing supply, although demand from home buyers exists. The short supply has resulted in higher competition for existing houses on the market last month, as low inventories have reduced choices and pushed prices up. Still, the housing market recovery is on track, given a tightening labor market. Other housing market indicators, including groundbreaking on new projects, building permits, and builder confidence, give an encouraging picture for housing. The Realtors have forecasted the national median home price in 2015 to increase 6.5% from 2014 to $221,900, which would match the record high set in 2006. They predict sales for the year to increase 6.6% to 5.27 mn, about 25% below the last peak set in 2005. Regionally, in the Northeast, pending home sales were 0.4% higher in June from the previous month. In the Midwest and South, home sales fell 3% from May. In the West, they rose just 0.5%.

Meanwhile, mortgage rates also surged slightly higher in June, leading to a weaker purchasing power, especially for first-time home buyers who are rate-sensitive. Applications for U.S. home mortgages inched up last week, while borrowing rates edged down.

The seasonally adjusted index of mortgage application activity, which includes both refinancing and home purchase demand, increased 0.8% in the week ended July 24, as per the Mortgage Bankers Association. The MBA’s seasonally adjusted index of refinancing applications was 1.6% above the previous week’s applications, while the Purchase Index, a gauge of loan requests for home purchases and a leading indicator of home sales, dipped 0.1%. The refinance share of total mortgage activity rose to 50.6% of applications from 50.3% the week before. Fixed 30-year mortgage rates averaged 4.17% in the week, down 6 points from the previous week.

Market Trends is provided by Fund&Grow – an organization dedicated to funding entrepreneurs and small business owners. Interested in $50,000 to $250,000 of business credit at zero or very low interest with no impact on your personal credit? Get funded now. You can also click here to sign up to get more market updates and cutting edge news about credit and funding for your business.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share