** DRAFT - NOT PUBLICALLY VISIBLE **

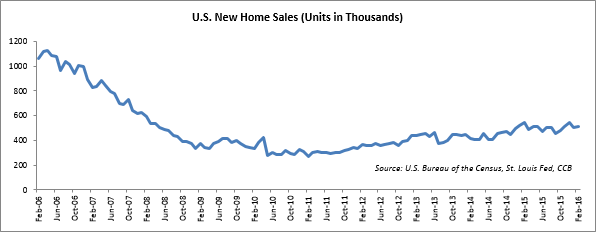

U.S. new home sales rose slightly in February, but gains were mostly limited to a single region – which may indicate a slowdown in the housing market.

In February, home sales increased 2% to a seasonally adjusted annual rate of 512,000 units. January's figures were revised upwards to 502,000 units against 494,000 units reported previously. Economists had expected new home sales to rise to 510,000 units last month.

On a region-wide basis, single-family new home sales surged by 38.5% in the West, in contrast to a 32.7% fall in January. Sales plummeted by 24.2% in the Northeast, 17.9% in the Midwest and 4.1% in the South.

About 9.2% of the total housing market is comprised of new home sales. Excluding the Western region, total home sales dropped by 8.1% in February.

According to economists, February's weak sales were the result of a decline in contract signings in January due to snow storms. Housing market fundamentals are still viewed as strong by most experts, thanks to historically low mortgage rates and a strengthening labor market. Sophia Kearney-Lederman, an economic analyst at FTN Financial in New York, said “We expect the housing market to continue to be a moderate but unremarkable contributor to growth for the remainder of 2016.”

Nevertheless, a lack of homes for sale in the housing market is pushing up prices and reducing the availability of options for buyers. Last month, the total stock of new homes in the market increased 1.7% to 240,000 units – the most since October 2009.

That said, housing inventory still remains less than half of what it was at the height of the housing bubble. Considering February's sales rate, it would take 5.6 months to clear the supply of houses on the market. Compared to a year ago, the median price of a new home increased by 2.6% to $301,400.

The report on U.S. new home sales comes in the wake of existing home sales data released by the National Association of Realtors (NAR). Sales of previously owned homes sank in all four regions in February, due to rising prices and low inventory.

Compared to January, sales of existing homes fell 7.1% last month to a seasonally adjusted rate of 5.08 mn, much below economists' estimates of a 2.8% decline to a rate of 5.32 mn. Sales increased by 2.2% compared to a year ago.

Mr. Lawrence Yun, chief economist at NAR said, "The main issue continues to be a supply and affordability problem." Other factors that seem to have contributed to a fall in sales are a tumbling stock market and the East Coast blizzard in January.

In February, the inventory of existing homes for sale declined 1.1% from a year earlier; however, compared to January, it increased 3.3% to 1.88 mn. This translates into a 4.4-month supply at the current sales rate, and is slightly more than January's supply of 4.0 months. Normally, a six-month supply is considered to be a healthy balance between supply and demand.

Last month, the median price for an existing home was $210,800, 4.4% more than a year earlier. This increase in price marks the 48th straight month of year-over-year gains.

Sales of existing homes fell across all regions in the U.S., tumbling by 17.1% in the Northeast, 13.8% in the Midwest, 3.4% in the West and 1.8% in the South. The recent housing data is in sharp contrast to reports indicating robust job growth and stabilization of factory output, which had been adversely affected due to a strong U.S. dollar and weak demand overseas.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share