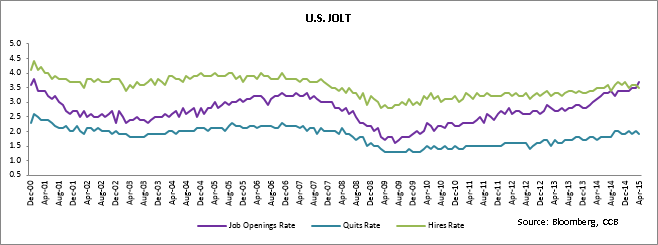

U.S. job openings surged to a record high in April, after a slight decline in March, hinting at a stronger job market in the coming months. The April job openings of 5.4 million were higher than the 5.1 million in March, and market expectations of +5.044 million, said the Labor Department in its monthly Job Openings and Labor Turnover Survey (JOLTS).

The quit rate was 1.9% in April versus 2.0% in March, with about 2.7 million people switching jobs in April. This indicates a rising confidence among people in getting better employment opportunities.

At the same time, the hiring rate was little-changed at 3.5% in April, from 3.6% in March, as the hires declined to 5.01 million from 5.09 million. Hiring in the construction sector was the highest in April, while hiring fell in professional and business services, leisure and hospitality, and trade/transportation utilities.

The JOLT survey report came in after the Labor Department reported an addition of 280,000 workers to payrolls in May, above forecasts. About 221,000 jobs were added in April. JOLTS is closely watched by the Fed officials who are contemplating a short term interest rate hike. The progress in the labor market, coupled with last week’s strong jobs data, increases the prospect of a rate hike in September, which looked difficult after the a negative Gross Domestic Product growth of 0.7%.

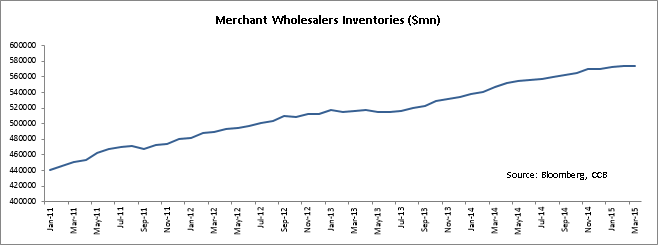

U.S. wholesale inventories surged higher than expected in April on steady oil prices – which bolstered wholesalers’ sales. The rise in sales induced optimism among wholesalers who are ramping up stock and anticipating higher demand. Wholesale inventories climbed 0.4% to $576.9bn Month-over-Month (MoM) in April, the Department of Commerce said on Tuesday.

The rise in inventories exceeded the consensus estimate of 0.2% MoM, as well as a revised 0.2% gain in March, soaring up 4.5% Year-over-Year (YoY). The U.S. wholesalers’ sales surged in April at the fastest pace in 13 months.

Sales increased 1.6% after slowing down since August last year. The slump in sales was driven by weak petroleum goods sales on the back of lower oil prices. This resulted in inventory pile up with wholesalers.

Despite sales being high for April, they were down 3.3% YoY. Taking into account the rate of sales growth in April, it will take 1.29 months to convert stock into sales, slightly down from 1.30 months in March. The inventory-to-sales ratio, which indicates an unwanted inventory build-up, will force wholesalers to liquidate stocks and put pressure on manufacturing and economic growth. Wholesale stocks excluding autos – rose 0.2%, against a 0.1% rise in March.

Both wholesale and retail sales are expected to rebound in the second quarter with a pick up in consumer spending. In 1Q15, consumers remained cautious of a stronger dollar and a plunge in energy prices that restricted business investments, particularly in energy sector. GDP is expected to grow at 2%-2.5% in the 2Q15 on a stronger job market, which should boost consumer incomes and consumer spending.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share