** DRAFT - NOT PUBLICALLY VISIBLE **

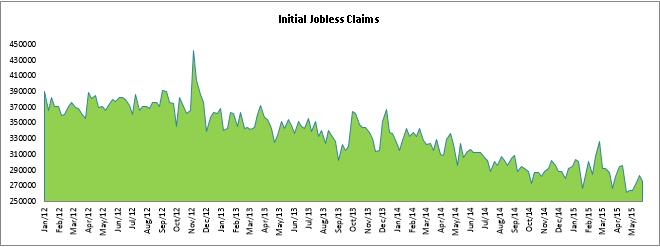

The job market data released today indicated an improving U.S. employment level. May ended with a positive report on the initial jobless claims, while labor productivity and cost data were negative. Initial jobless claims fell by 8,000 to 276,000 in the week ending on May 30, the Labor Department said on Thursday. The fall in the U.S. unemployment benefit claims was higher than the consensus estimate of 279,000. The four-week average of new claims, which is a better measure of jobless claims as it evens out the weekly volatility, over the past month moved up 2,750 to 274,750. Initial jobless claims remain below 300,000 for the 13th straight week and were near to 15-year lows, which indicates firming job market and lower layoffs. About 223,000 jobs (versus 85,000 in the prior month, the lowest since June 2012) were created, beating estimates. Continuing jobless claims also declined 30,000 to 2.2 mn in the week ended May 23, the fewest since November 2000. The unemployment rate among people who are eligible for such claims edged down to 1.6% from 1.7%.

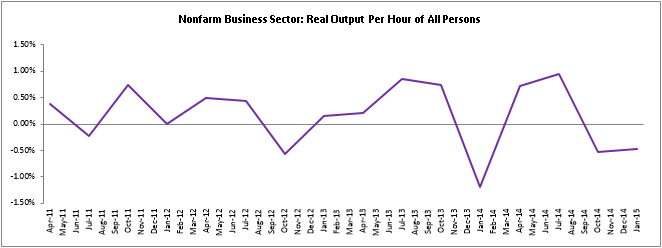

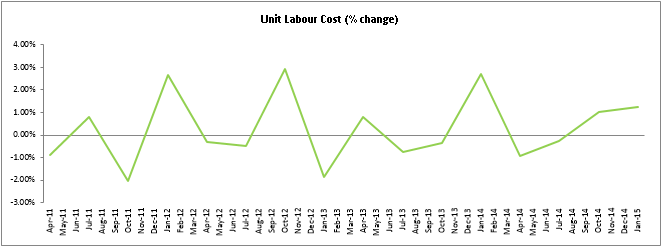

Another industry report on nonfarm labor productivity reflected a lower efficiency amongst the U.S. labor force in the first quarter. Nonfarm productivity fell 3.1% Quarter-over-Quarter (QoQ) from a 1.9% drop in the previous quarter, according to the Bureau of Labor Statistics. The dip in labor productivity was 1% higher than the 2.1% fall in the preceding quarter, and was the largest consecutive decline in over two decades. The lower productivity resulted in higher labor costs. Labor unit costs gained 6.7% QoQ in the first quarter, the fastest rate of increase since 1Q14, higher than the estimates of a 5.9% jump. Unit labor costs increased upward from 5.6% QoQ rise in 4Q14. Compared to the previous year, labor productivity gained a negligible 0.3% with a slower increase in work hours in 1Q15. Work hours increased at a rate of 1.6% versus a 1.7% rise in the previous quarter. The gain in worker’s hourly compensation was revised upwards to 3.3% in 1Q15 versus a previously reported rise of 3.1%.

A higher than expected fall in initial jobless claims increases the prospects of a September rate hike. However, the decline in productivity pushed the Gross Domestic Product in the negative territory of 0.7% in 1Q15 and a sustained lower productivity. This raises the risk of a rapid increase in inflation, which would mean an urgent rise in the Federal interest rate.

The Fed Governor, who is keen on a rate hike in 2016, highlighted a strong dollar, pulling down exports and hence manufacturing. A delay in a rate hike would further give time to closely observe the macro data which would provide clarity on the economic health. However, the Fed chair is more optimistic and expects a rate hike in 2015.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share