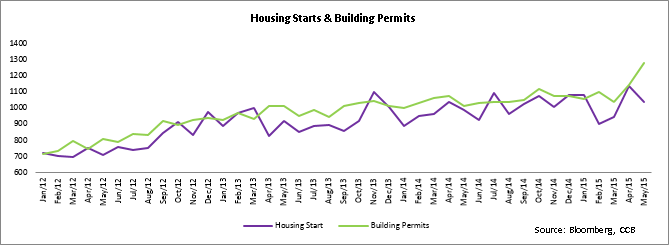

Housing starts, which is defined as construction of a new building intended primarily as a residential building, retreated in May after a robust increase in the previous month. The dip in single family construction, which forms the largest portion of the market, primarily drove the decline.

However, an increase in building permits for future construction rose to a near eight-year high. This indicates a healthy real estate supply going forward. Positive builder confidence, coupled with warmer weather, drove the rise in housing starts in April. Harsh winter weather had slowed housing starts in February and March. The May decline in starts should be temporary and is expected to rebound, although below the levels touched in April.

Residential construction starts declined 11.1% month-over-month (MoM) to 1.04 mn units in May, the Commerce Department said on Tuesday. The fall in housing starts was larger than market expectations of a 3.1% decline to 1.1 mn in May.

In April, housing starts posted a surprise gain of 20.2% to 1.17 mn, the largest over the past seven years. Construction for single-family homes tumbled 5.4% to 680,000 units, while multifamily housing starts slipped by a significant 20.2% to 356,000 units. Regionally, housing starts dropped in all four regions. The northeast saw the largest decline of a sharp 26.5% following April’s massive rise of over 20%. Starts in the south, where most of the home building takes place, dropped 5%, higher than the 1.8% decline in the previous month.

Building permits for future home construction jumped 11.8% to 1.28 mn in May, the highest since August 2007. The rise in permits was in contrast to market expectations of a fall of 3.5% to 1.1 mn units. Single-family building permits increased 2.6% after a 3.7% jump in April.

The May permits were the highest since December 2014. Multifamily building permits climbed 24.9%. The uptick indicates builder confidence in the housing market. Housing activities should likely accelerate after being hurt by a harsh winter in the 1Q15, given a strengthening labor market and improving wage rates.

The National Association of Home Builder’s (NAHB) Housing Market Index on Monday reflected high confidence among builders and new home sales. It also showed single family constructions are gaining momentum.

The NAHB Index hit the highest level of the year in June, inducing optimism over the housing market. The index jumped 5 points to 59.0 from 54.0 in May, above the expectations of 56.0 in June. A level above 50.0 indicates a favorable outlook on home sales.

A growing labor market will boost consumer income and mortgage rates, which are prevailing at the lowest levels since June 2013. This will make housing investments cheaper and bodes well for the construction industry. The 2Q15 started off well with high builder sentiments on housing industry. The housing demand is expected to pick up as reflected by the jump in building permits.

Market Trends is a service of Fund&Grow – an organization helping small businesses and investors get the credit and funding they need to run their businesses. Click here to sign up to get more market updates and cutting edge news about credit and funding for your business.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share