MARKET TRENDS: Higher Consumer Spending Boosts GDP in 2Q15, Although Lower Than Expected

July 31, 2015

July 31, 2015

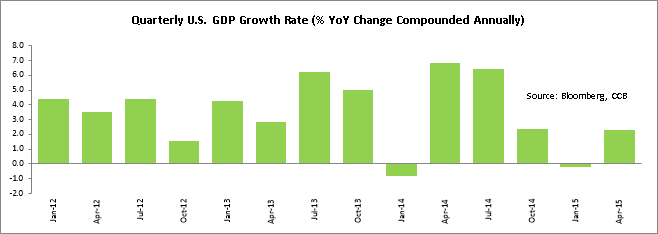

U.S. economic growth strengthened in the second quarter of 2015, although slower than anticipated, after a soft first quarter. The Gross Domestic Product, the value of total production, grew at a 2.3% annual rate from April to June, the Commerce Department said on Thursday. The gain in GDP growth was, however, lower than the market expectations of 2.6%.

Economic growth for the first quarter was also revised to 0.6%, from the initially reported contraction of 0.2%. The revision reflected the steps taken by the government to refine the seasonal adjustment for some components of the GDP. Growth in the second quarter was boosted by consumer spending, which was driven by cheaper gasoline in late 2014, and early this year. The strengthening labor market also encouraged consumers to spend instead of save. The saving rate fell to 4.8% from 5.2%. The housing market, which showed strength, also contributed to the GDP gains.

In the second quarter, consumer spending jumped 2.9%, up from a downwardly revised 1.8% pace in the first quarter, and higher than the consensus estimates of a 2.7% rise. Households increased their spending on new autos at the fastest pace since the recession ended more than six years ago.

Encouraged by rising demand, especially for townhouses, condos, and apartment units, home builders raised their spending on new home construction at 6.6%, following a 10% increase in the prior two quarters. U.S trade also improved, which gave a further boost to the economic growth. Exports climbed 5.3% after a 6% drop in the first quarter. Imports rose at a slower 3.5% pace.

Inflation, as measured by the PCE price index, increased at a 2.2% annual rate after falling by 1.9% in the first quarter. The drop was led by plunging gasoline costs. Excluding food and energy, core PCE rose to a 1.8% annual pace, up from 1% in the first quarter of the year. This is near to the Fed’s target of inflation below 2%.

However, the gain in GDP growth rate was partially offset by weak business spending, particularly in the energy sector – due to lower oil prices. Tepid business investments were a setback in the second quarter. Spending on structures such as buildings and plants fell 1.6% and outlays on equipment declined 4.1%. The value of inventories fell slightly to $110 bn from $112.8 bn.

Earlier on Wednesday, the Fed described the economy as moderately expanding, while the labor market and housing showed strength. The Fed will be inclined to hike short term interest rates, in the event of a stronger employment report for July – which is scheduled for next week. The Fed’s assessment indicates a possibility of a September rate hike, which would be the first rise since 2006.

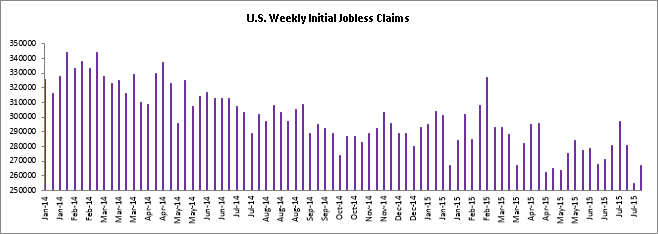

A separate report from the Labor Department showed applications for unemployment benefits claims increased 12,000 last week to a seasonally adjusted 267,000. This is lower than the market expectations of an increase of 15,000 applications to 270,000. Initial jobless claims stayed below the 300,000 mark, which is indicative of a stronger labor market. The 4-week moving average fell by 3750 to 274,750. Thursday’s claims report showed continuing claims rose 46,000 to 226,000 in the week ended July 18.

The U.S. stocks opened lower on Thursday after the slower than expected GDP data. The dollar extended gains against a basket of currencies, and prices for U.S. Treasury debt fell slightly.

Market Trends is provided by Fund&Grow – an organization dedicated to funding entrepreneurs and small business owners. Interested in $50,000 to $250,000 of business credit at zero or very low interest with no impact on your personal credit? Get funded now. You can also click here to sign up to get more market updates and cutting edge news about credit and funding for your business.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share