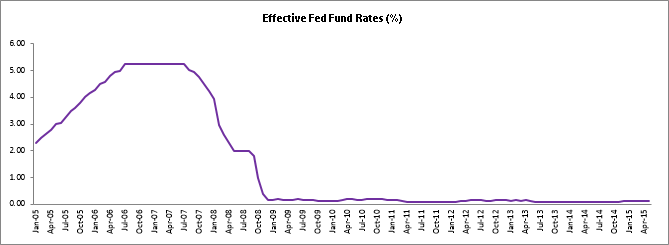

The U.S. Federal Reserve is on track to raise historically low interest rates on the back of an improving economy and after a winter setback. However, the Fed remains unsure of the second rate hike timing. It believes that the economy should be strong enough to support the rate hike by the end of 2015, but concerns remain over the labor market recovery.

The Central Bank has confirmed that at least one rate hike will be executed this year. It stated in the two-day Federal Open Market Committee held on Wednesday that the rates are likely to climb more gradually than previously anticipated.

A September rate hike could be possible as the growing economy is translating into higher jobs and wages. The last reported retail sales data were solid, while consumer spending and the housing sector have shown some signs of progress. The Gross Domestic Product is likely to rebound in 2Q15, after contracting to -0.7% in 1Q15. Policymakers expect the GDP to be in the range of 1.8% to 2.0% in 2015, down from a March forecast of 2.3% to 2.7%.

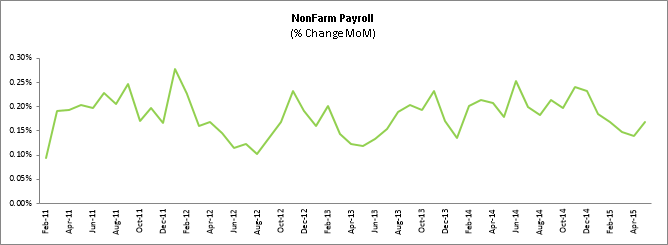

The unemployment rate remained steady and is expected to be slightly higher at the end of 2015, at 5.2% to 5.3%, despite continued improvement in labor markets, owing to low labor force participation and a high level of part-time employment. The unemployment rate in May was 5.5%.

The Fed is looking for further decisive evidence that labor markets are firming and wages will increase beyond their current muted growth. Business fixed investment, particularly in the energy sector and net exports remained soft.

Inflation was below the Committee’s longer-run objective, partly reflecting earlier declines in energy prices and falling prices of non-energy imports. As energy prices appear to have stabilized, inflation is expected to rise gradually to a 2% target over the medium term. Annual inflation is expected to be between 0.6% and 0.8% this year, well below the Fed’s 2% target.

In their projections, Fed officials also saw lower rates at the end of 2016 and 2017 than forecast in March, and more policymakers are now in favor of hiking rates only once or not all this year. It’s been a little bit negative for the dollar which fell as far as 94.017, from its intraday high of 95.178.

The S&P 500 utilities sector rose 0.8% after hitting its lowest since late Sept’14; S&P 500 index posted 21 new 52-week highs and 3 new lows; the Nasdaq Composite Index posted 138 new highs and 30 new lows. Treasury yields tumbled Wednesday. The 10-year note yield inched up 0.6 basis points (bp) to 2.32%, down from a high of 2.394%. The two-year note yield was down 3.7bp to 0.653%, from a high of 0.738%. The three-year Treasury yield was down 5.5 basis points to $1.027%.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share