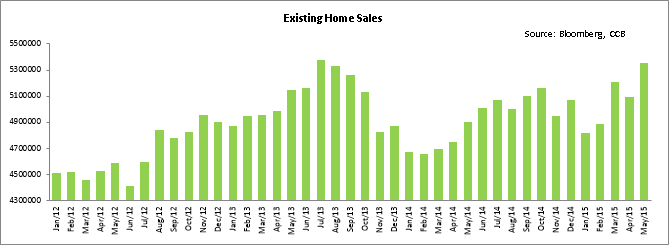

Existing home sales, which includes the number of previously constructed homes, condominiums, and co-ops, rebounded in May. It grew at its fastest pace since November 2009 and marked the third straight month of annual home sales above 5 mn.

Existing home sales accounts for a larger share of the market than new homes and is a powerful indicator of housing market trends. The housing industry impacts the economy as a whole, as it affects lenders, construction workers, and retail.

The May increase in housing sales was largely driven by a higher demand from first-time home buyers, which formed about 32% of the total housing clientele, up from 30% in April and 27% from a year ago.

Housing recovery has remained erratic since the end of 2014. A stronger hiring and wage rate, coupled with lower mortgage rates, have triggered the recent housing demand. The average rate for a 30-year fixed mortgage reached 4.04% in the week ended June 11, and was the highest rate of this year. However, it was below the 2014 average of 4.17%.

The National Association of Realtors posted a stronger than expected gain of 5.1% to 5.35 mn month-over-month (MoM) on Monday. The market expected existing home sales to rise 4.4% to 5.26 mn in May. The April annual existing home sales were revised to 5.09mn. Existing-home sales slowed in April with a decrease in sales of single family homes by 3.3% MoM to 5.04mn.

On Year-over-Year (YoY) basis, existing homes rose 9.2% from 4.9 mn and were up for 8 straight months. Rising demand exceeded housing supply, which fuelled home prices.

At the end of May, existing home inventory climbed 3.2% to 2.29 mn, and 1.8% higher than a year ago (2.25 mn). Unsold inventory is at a 5.1-month supply at the current sales growth, down from 5.2 months in April.

Single-family home sales jumped 5.6% to 4.73 mn in May from 4.48 mn in April, and were up 9.7% from 4.31 mn one year ago. Existing multifamily property sales, including condominium and co-op sales, increased 1.6% to 620,000 units in May from 610,000 units in April, and are up 5.1% YoY (590,000 units).

Region-wise, the Northeast saw the largest gain. Home purchases surged 11.3%, while in the Midwest home sales increased 4.1%. Existing home sales in the South and West were up by a similar 4.3%.

The second quarter of the year started with slower gains in the housing industry after a slump in the first quarter. Despite an 11.1% decline in housing starts in May to a 1.04 mn units, building permits surged to the highest level in nearly eight years last week. An improving economy has led to higher builder confidence. Builders are now optimistic on the housing outlook, as indicated by the National Association of Home Builders/Wells Fargo Builder Sentiment Index, which advanced in June to the highest level since September.

The strengthening housing industry keeps the Federal Reserve on course to raise interest rates later this year. The price of gold dropped to a two month low on Monday, after the solid existing home data was released, while the U.S. stocks extended gains on the housing data.

Hopes of a deal to prevent a debt default by Greece also buoyed market sentiment. The housing index was up 0.76%. The dollar was little changed, while prices for U.S. Treasury debt fell.

Market Trends is a daily analysis courtesy of Fund&Grow, the industry leader in zero-interest business funding. Interested in $50,000 to $250,000 of business credit with no impact on your personal credit? Get funded now.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share