** DRAFT - NOT PUBLICALLY VISIBLE **

U.S. crude oil inventories dropped for yet another week, making for a sixth straight fall. Inventories slipped by 6.81 million barrels in the week ending June 5, as per the latest data from the Energy Information Administration (EIA).

The oil inventories declined more than the expected rate of 1.7 million barrels per day (MBPD) for the week. Total crude oil inventories were down to 470.6 million barrels after the decline. Yet despite the falls, crude oil stock was at the highest levels for this time of year in at least eight decades. Crude oil inventories shrunk 1.9 MBPD in the week prior.

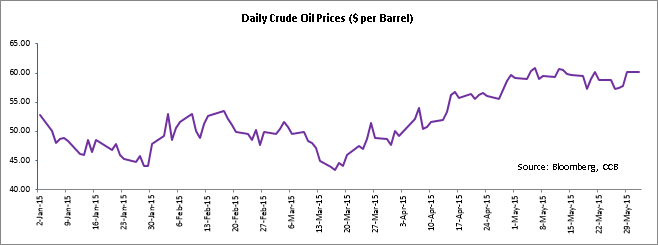

Following the EIA report, West Texas Intermediate crude oil prices declined to $60.84 per barrel. Oil prices hit a level above $61 earlier on Wednesday in anticipation of falling oil inventories and a decline in production after sharp increases in the past.

The U.S. crude oil prices have traded in the range of $57 to $62 per barrel in the recent weeks, as oil demand improves and U.S. production ramps up. According to the EIA’s latest short-term monthly outlook released on Monday, U.S. crude production is expected to fall from 9.6 MBPD in May until early 2016.The EIA also increased its forecasts for oil demand globally by 20,000 BPD to 1.25 MBPD through 2016.

The American Petroleum Institute (API) late Tuesday reported a decline of 6.700 million in Weekly Crude Stock, from 1.800 million in the preceding week. The API report came in before the U.S. government predicted a stronger fall in domestic oil production.

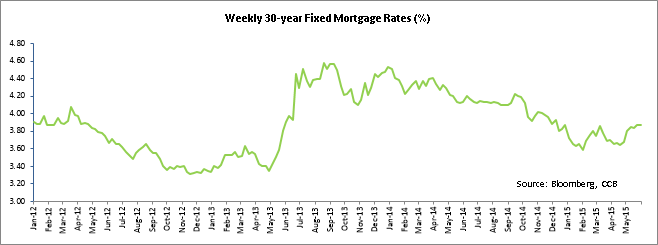

Mortgage rates surged higher on Tuesday in light of a weak bond market. Solid May Non-Farm Payroll data led to a huge bond selloff on Friday, while news on the European bond buying program, to run in full swing through 2016, contributed to the weakness in the bond markets. The financial market will be largely affected in the event that Greece fails to pay back the debt to its creditors, which is due at the end of the month.

Fixed 30-year mortgage rates in the U.S. averaged 4.17% in the week ending June 5, 2015, up 15 basis points from 4.02% in the previous week. The 30-year Mortgage rate, which was at its 8-month high, boosted the applications for the U.S. home mortgages. The Mortgage Application Activity Index, which includes both refinancing and home purchase demand, rebounded after a decline in the previous week.

According to the Mortgage Bankers Association (MBA), the Mortgage Application Index climbed 8.4% in the week ending June 5 from a drop of 7.2% in the prior week. The MBA’s index of refinancing applications, which formed about 49% of the total mortgage activity, gained 7%. The measure of loan requests for home purchases, a leading indicator of housing sales, advanced 9.7%. Strengthening labor markets, indicated by strong job gains in May, coupled with improving wage growth, are bolstering housing demand.

Mortgage rates surged higher on Tuesday in light of a weak bond market. Solid May Non-Farm Payroll data led to a huge bond selloff on Friday, while news on the European bond buying program, to run in full swing through 2016, contributed to the weakness in the bond markets. The financial market will be largely affected in the event that Greece fails to pay back the debt to its creditors, which is due at the end of the month.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share