** DRAFT - NOT PUBLICALLY VISIBLE **

The US housing industry remains healthy – despite a slowdown in overall growth of the broader economy in the third quarter of 2015.

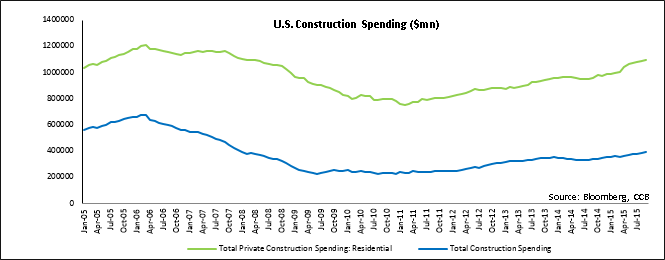

Construction spending in September was near an eight-year high. Third quarter GDP growth estimates slid to a 1.5% annual pace, compared to a 3.9% rise in the April to June quarter. This was due to lower business inventories, stronger currency and reduced investments in the oil sector.

However, the gains in construction spending, private spending in particular – which forms the largest component of the total spending, indicate modest upward revisions to the quarter GDP estimates.

Construction spending grew 0.6% to $1.09 tn in September, the highest level since March 2008, following a 0.7% rise in August, stated the Department of Commerce.

The rise in spending was attributed to higher spending in private construction. Spending on private residential construction jumped 1.9% in September, with an increase in home building and renovations. Construction of apartments and condominiums shot up 4.9% in September from the previous month, while construction of single-family homes grew 1.3%.

Private investment in housing grew 6.1% p.a. since July. On a yearly basis, private spending on housing construction increased 17.2%. Overall construction spending was estimated to rise 0.5% in September. Construction spending jumped 14.1% year-over-year.

The increase in spending boosted supplies of new homes and eased the current tight market which has lead to an increase in home prices (4% to 5% annual rate). September’s construction spending also slightly exceeded the government forecasts in its advance third-quarter GDP estimate released last week.

Investment in private non-residential construction projects, however, fell 0.7%, while public construction expenditures gained 0.7%. Spending on state and local government projects, the largest part of the public sector, climbed 0.9%. Federal government spending was down by 1.0%.

Loan Applications Improve and Interest Rates Rise

A slower decline in mortgage applications last week is good news for the housing industry. The seasonally adjusted Mortgage Composite Index, a measure of mortgage loan application volume, decreased by 0.8% in the week ending October 30, 2015, versus a 3.5% fall in the previous week. The MBA’s refinance index dropped by 1% from the previous week, and the share of all new applications for refinancing grew from 59.5% to 59.7%.

While applications were improving, mortgage loan rates increased slightly on all types of loans last week in anticipation of a hike in the short term interest rate by the Federal Reserve. This could be alarming, as any increase in the long awaited interest rate, along with rising home prices, would make home borrowing a costlier affair.

However, the rise in loan applications is encouraging. September new home sales, as well as existing home sales, were up 2% and 8.8% year-over-year, respectively. Last week, the average mortgage loan rate for a 30-year fixed-rate mortgage was up from 3.98% to 4.01%, and the rate for a jumbo 30-year fixed-rate mortgage increased from 3.88% to 3.90%. The average interest rate for a 15-year fixed-rate mortgage rose from 3.22% to 3.24%.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share