** DRAFT - NOT PUBLICALLY VISIBLE **

Following a series of disappointing economic data, the U.S. economy showed some strength in May as the Manufacturing Index rose higher than expected. U.S. construction spending surged in April to the highest level in nearly 6.5 years, triggered by larger investments in the private sector. Still, the jump in manufacturing and construction spending seems insufficient to overshadow a larger decline in the gross domestic product.

U.S. construction spending climbed 2.2% month over month (MoM) to $1.0 trillion, the highest level since November 2008, exceeding the market estimate of +0.7%, the Commerce Department said on Monday. A 1.8% MoM rise in private construction spending, the highest since October 2008, drove the increase.

Investments on private residential construction were up 0.6% MoM, while the private non-residential construction projects shot up 3.1% to the highest level in six years. A 3.9% MoM increase in spending on state and local government construction projects, which forms a larger portion of the public sector spending, led a 3.3% MoM rise in public construction spending. This offsets a 3.6% fall in Federal government outlays.

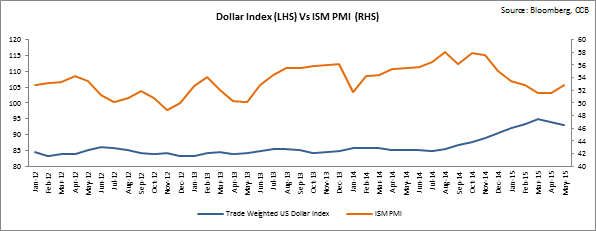

The Institute for Supply Management (ISM) said its Manufacturing Index was at 52.8 in May, slightly above the economists’ estimate of 52.0, and April’s reading of 51.5. Manufacturing activities rebounded in May from its two year lowest growth in the previous month as new orders and employment recovered.

Increasing demand and the smooth flow of goods through the West Coast ports helped manufacturers to bag new orders. The Employment Index expanded to 51.7 in May after reporting a below 50 reading of 48.3 in April. The New Orders Index rose to 55.8 from 53.5 in April, the highest since last December. The Prices Paid Index reached its highest level since October, swelling to 49.5 from 40.5 in April, but still below the market forecast of 43. Although the Production Index slipped 1.5 points to 54.5, it was well above the 50 mark that indicates expansion in the manufacturing sector.

As per the ISM report, 14 out of 18 industries reported growth. Textile, computer and electronic products were the ones tightening, while automotive continues to remain strong. However, the economy still suffers from a strengthening dollar and lower oil prices that have led to depressing demand in the miserable energy sector.

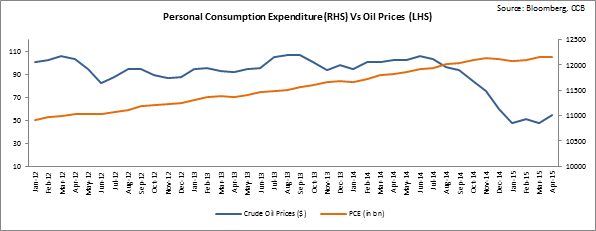

U.S. personal consumption expenditures remained flat in April against an estimate of +0.2% MoM and below +0.5% in March, said the Commerce Department on Monday.

Demand for utilities remained weak on improving weather conditions. Despite a better growth in household income, driven by lower energy costs, expenditures remain low. Cautious consumers focus more on savings amidst an uncertain economy and a sluggish job market growth. A Fed rate hike in such a scenario looks difficult.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share