** DRAFT - NOT PUBLICALLY VISIBLE **

This week, beginning on Monday, we’ll see reports on household consumption expenditures and US manufacturing activities; both of which have remained weak due to a slowing US economy. Low factory orders on moderated manufacturing activities, as opposed to a growing service sector, will follow in the middle of the week. US employment data, including nonfarm payrolls and unemployment levels, will be covered at the end of the week.

Core PCE Index (Mon): Consensus estimate for the core personal consumption expenditure Index, a measure of prices paid by people for domestic purchases of goods and services, excluding the prices of food and energy, was 0.2% in April versus 0.1% in the previous month. Consumer product prices rose by 0.1% (month over month) in March against forecasts of 0.2%. Despite a better growth in household incomes, driven by lower energy costs, expenditures remain low. Household expenditures are expected to remain low as consumers remain cautious on uncertain economic conditions and a sluggish job market growth.

ISM Manufacturing PMI (Mon): The May ISM Purchasing Manager’s Index is expected to inch up modestly to 52, in contrast to April’s dip of 51.5, a fifth consecutive decline. A strong dollar has impacted the export business, particularly in the transportation equipment sector and the chemical industry. Additionally, the west coast port strikes have hurt foreign shipments for electronic products. This offsets a strong production and order book in the Primary and the Fabricated Metal sector, and a stronger bottom-line in the food, beverage & tobacco products helped by low energy prices.

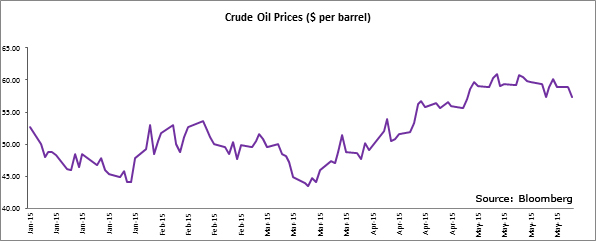

Factory Orders (Tues): A slowdown in the US economy, a strong dollar and falling oil prices have led to weak demand for consumer products resulting in moderated manufacturing activities at the US factories. The Factory Orders rose 0.2% (month over month) in April, well below last month’s 2.1% rise. Orders for overall durable goods declined more than expected, while orders for core durable goods (ex. transportation equipment) were better than estimated. Business investments are low from oil companies as oil prices remain volatile. Prices surged to over $60 per barrel at the end of April but have softened a bit. Still, prices have recovered from the beginning of 2015 when they were below $50 a barrel.

ADP Nonfarm employment Change (Wed): The ADP National Employment is expected to increase 39,000 to 200,000 in May. The private sector added about 169,000 jobs in April, the lowest since January. The ADP employment figures come two days ahead of the U.S. Labor Department’s more comprehensive non-farm payrolls report, which includes both public and private-sector employment.

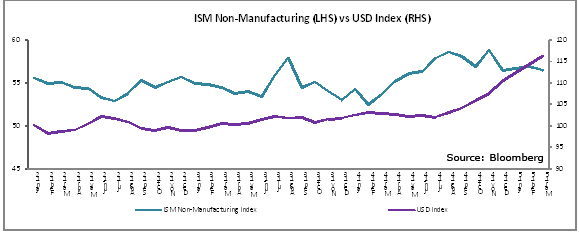

ISM Non-Manufacturing Index (Wed): Service sector activities grew at a slower pace in May on a weak US economy. The ISM Non-Manufacturing Index is likely to edge down to 57 in May, from 57.8, in April when service sector activity grew at its fastest pace, over the past five months, and exceeded estimates of 56.2. However, unlike the manufacturing sector, service exports are rising, particularly in management consulting, transportation and warehousing, as well as the entertainment industry, which are probably more immune to the rising dollar rates. The index does not impact GDP growth rate as much as the manufacturing index.

Nonfarm Productivity (Thurs): The Q1 nonfarm productivity is expected to decline 2.9% q/q, larger than the 1.9% fall in the previous quarter, on a negative revision to nonfarm output growth in the government release on Q1 GDP to -1.6% from -0.2%. Labor costs were revised upward to 6.4% from 5%. The GDP growth of 0.7% was weaker than the initial growth estimate of 0.2% y/y for Q1 driven by lower productivity across all industries on a rising US dollar that hurt export business. A weaker than expected GDP growth, would further delay a Fed interest rate hike that is expected in September this year.

Nonfarm Payrolls (Fri): The nonfarm payroll is expected to increase slightly by 2,000 to 225,000 jobs in May after exceeding the expected 223,000 increase in April. The small rise in May reflects weak employment levels in construction, mining and manufacturing. Oil companies have recently stressed layoffs as oil prices fall.

Unemployment Rate: The consensus estimate for the May unemployment rate is unchanged, at 5.4%, following the previous month as the gap between supply and demand for employment has lowered. Jobs have been created in professional and business services, health care, and construction, while mining employment continued to decline on the back of lower oil prices. Average hourly wages are expected to increase 0.3% in May after a modest 0.1% rise in the previous month.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

have a question?

Our business experts are available to answer questions Monday - Friday from 9:00 a.m. - 6:00 p.m. EST

Call Us:

(800) 996-0270

Email Us:

service@fundandgrow.com

Watch our Masterclass:

Access up to $250K in 0% Business Credit

Let's Stay Connected on Social Media!

* "Funding" typically comes in the form of the issuance of business credit cards that may be used for business purposes. In such instances, we consider these credit lines as funding since businesses may tap those lines.

** Zero-Interest is based on the personal credit-worthiness of the business owner. 0% rates are introductory rates and vary in length of time, assuming all monthly required payments are made to the credit card company. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement from the lender. Fund&Grow is not a lender.

*** The 60-day money-back guarantee only applies if client does not obtain credit. Please refer to the full Terms of Service for additional details.

Contact

Information

"Fund&Grow was created to empower small business owners, but more importantly, to support entreprenuers in achieving their business and personal goals while they lead the way towards innovation." - Ari Page CEO of Fund&Grow

Ari Page and the Fund&Grow team help business owners obtain access to credit despite the ambiguous lending climate. Many people feel ripped off and scammed by the bank bailouts and wonder why they can't use the system to their advantage the way the big banks did. If you have good credit, the Fund&Grow program will get you the funds you need to grow your business.

Find 4,000+ 4.9-star average customer testimonials on the following platforms: SoTellUs, Trustpilot, Google, BBB, among others.

All credit is subject to lender approval based upon credit criteria. Up to $250,000 in business credit is for highly qualified files over the term of the membership with multiple credit card batches and/or credit lines. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement. Fund&Grow is not a lender.

© 2025 Fund&Grow. All Rights Reserved.

Share

Share