A lot of business owners are searching for funding to cover daily expenses, invest in equipment, or scale faster, but aren't always sure which option makes the most sense. In 2024, 77% of small business owners reported that access to capital was their greatest challenge. With that kind of pressure, making smart financial decisions matters more than ever.

Business credit and business loans are two of the most common ways to access capital. They're both useful, but they work in very different ways. One offers flexibility and can help build your credit profile over time. The other provides a lump sum and structured repayment that's better suited for bigger, planned expenses.

This article will discuss the key differences between business credit and business loans, explain the pros and cons of each, and help you figure out which option fits your current business needs.

Key Takeaways

- Business credit is a flexible option that works well for managing daily expenses, optimizing cash flow, and building your business credit profile over time.

- Business loans offer larger funding amounts with lower interest rates and longer repayment terms, making them better suited for big, planned investments.

- Business credit cards are easier and faster to qualify for, especially for newer businesses, startups, and self-employed individuals.

- Business loans usually require more paperwork, stronger credit, and sometimes collateral, but they give you predictable payments and structured financing.

- Let Fund&Grow help you secure up to $250,000 in 0% interest business credit and build a stronger financial future.

What Is Business Credit?

Business credit usually refers to a credit card or line of credit that's tied to your business, not your personal name. It provides you with access to funds that you can use when needed, and you only pay interest on the amount you actually use.

Pros of Business Credit

- Flexible access to funds whenever you need it

Business credit cards work on a revolving basis, meaning you can borrow, repay, and borrow again without needing to reapply. If your business has ongoing expenses like supplies, marketing, or travel, this flexibility can make daily operations much smoother. Paying your full balance every month also means you avoid paying any interest.

- Dedicated rewards that support business spending

Many business credit cards offer rewards like cash back, airline miles, and bonus points. You can often earn extra rewards on common expenses like office supplies, travel, utilities, and shipping. Some cards also offer sign-up bonuses and 0% introductory APR periods, which can be a huge help when covering startup costs or making bigger purchases without immediate interest charges.

- Easier to qualify for compared to business loans

Unlike traditional business loans, you don't always need years of operating history or high revenue to get approved for a business credit card. Many issuers focus more on your personal credit and income.

- Fast and simple application process

Applying for a business credit card is usually quick. Many applications only require basic personal and business information and approval decisions can be made within minutes. This is a big advantage if you need access to working capital right away without going through piles of paperwork.

- Helps build your business credit profile

Using a business credit card responsibly is one of the easiest ways to start building a business credit history. On-time payments and smart credit usage can strengthen your business credit score over time, opening the door to bigger financing opportunities like larger loans or higher credit limits later on.

Cons of Business Credit

- High and variable interest rates if balances are carried

Business credit cards usually have higher interest rates than traditional loans. Rates can range from 18% to 36%, and they can fluctuate based on market changes. If you don't pay off your full balance each month after a 0% introductory period, interest charges can add up quickly and make debt expensive.

- Possible impact on your personal credit

Some business credit card issuers report negative activity, like missed or late payments, to personal credit bureaus. While responsible use may not be apparent, falling behind on payments can harm your personal credit score, making it more difficult to qualify for future funding.

- Limited federal protections compared to personal credit cards

Business credit cards do not have the same consumer protections as personal credit cards under the Credit Card Act of 2009. This means that interest rates, fees, and changes to your account terms may not be regulated as closely, and it's essential to review your card's terms carefully before applying.

What Is a Business Loan?

A business loan gives you a set amount of money upfront, which you pay back over time, usually with interest. It's different from business credit because it's not revolving. Once you use the money, you can't reuse it unless you apply for a new loan.

Business loans come in many forms, including:

- Term loans (fixed amount, paid over months or years)

- SBA loans (partially backed by the government)

- Equipment loans (used to buy tools or machinery)

- Working capital loans (to cover day-to-day operations)

These loans are often used for:

- Hiring staff

- Expanding to a new location

- Buying expensive equipment

- Starting a big project

Pros of Business Loans

- High borrowing limits for bigger opportunities

Business loans give you access to larger amounts of funding compared to credit cards. Many lenders, including SBA programs, offer loans up to $5 million. This makes them ideal if you're planning something major, like funding your construction business, opening a second location, purchasing expensive equipment, or investing in a large inventory for future growth.

- Lower interest rates that save money over time

Business loans usually offer better interest rates than credit cards. Depending on your qualifications, bank loans often range between 6.54% and 11.7%, while SBA loans range from 10.5% to 14%. These lower rates can make a huge difference, especially on larger amounts, helping you save thousands over the life of the loan.

- Longer repayment terms that protect your cash flow

Unlike business credit cards, which require full payment to avoid heavy interest, business loans give you years to pay the money back. Some SBA and commercial real estate loans even offer terms of up to 25 years. This longer runway can ease monthly pressure and make it easier to invest in growth without hurting your working capital.

- Fixed monthly payments for easier budgeting

Business loans usually come with predictable monthly payments. This consistency helps you plan ahead, manage your expenses, and avoid unexpected fluctuations that can strain your cash flow.

Cons of Business Loans

- Collateral may be required to secure the loan

Some lenders ask for physical assets like vehicles, equipment, inventory, or even real estate as security. For example, if you take out a $200,000 loan to expand your warehouse, the lender might require the property itself as collateral. If you cannot repay, the lender can take those assets to recover their money.

- Stricter qualification requirements

Getting approved for a traditional business loan can be tough. Lenders often want to see strong personal and business credit, stable financial records, and at least two years in business. Even alternative lenders, who are usually more flexible, still expect consistent revenue and a few months of operational history. A brand-new business with no established track record may struggle to qualify.

- Slower approval and funding times

Loans from banks or the SBA often involve a long paperwork process. You may need to submit tax returns, bank statements, business plans, and proof of revenue. Even after approval, it can take several days or weeks to receive the funds. For businesses that need fast cash to jump on an opportunity, this slower process can feel frustrating.

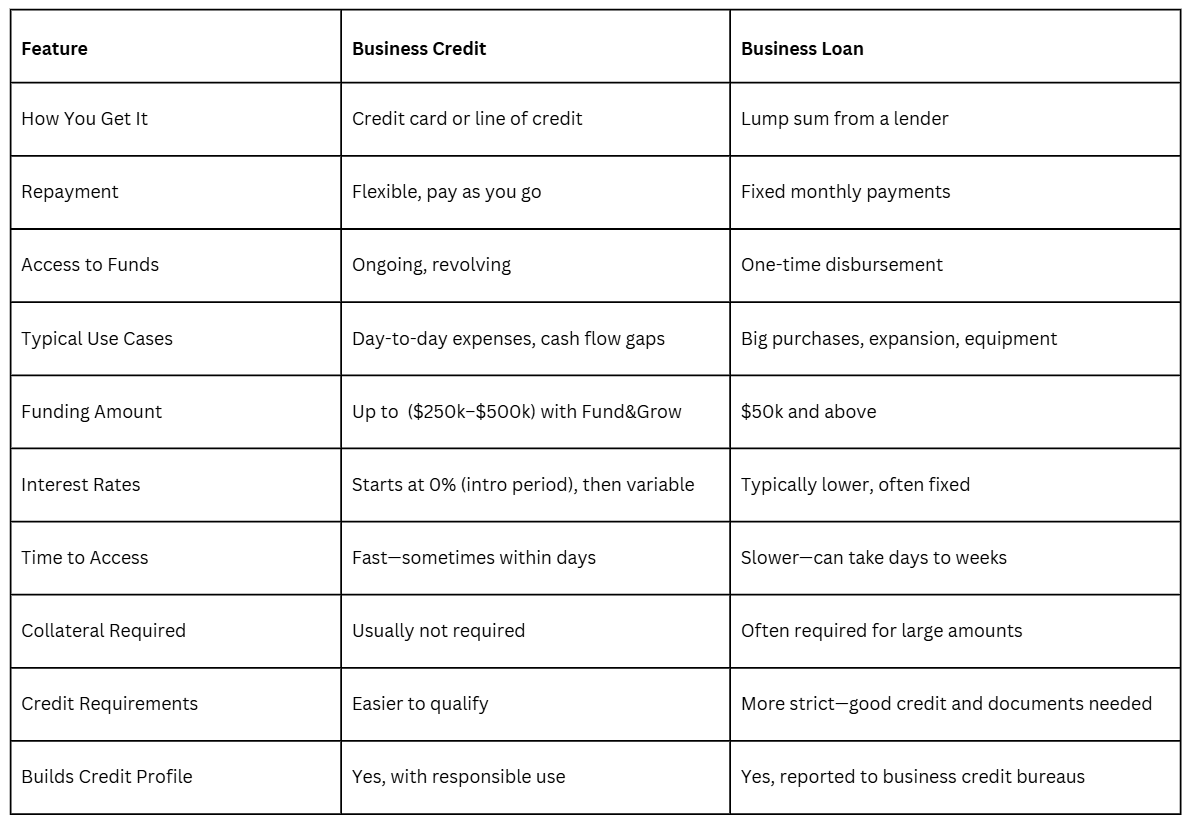

Business Credit vs. Business Loans: A Side-by-Side Comparison

Here's a quick comparison to help you see how business credit and business loans work:

How to Choose What's Right for You

Business credit and business loans are both strong funding tools. The right choice depends on how you want to access the money, how you prefer to repay it, and what you are planning to finance.

Business credit offers flexibility for both small and large expenses. Many of our clients use business credit cards and lines of credit not only for everyday needs, but also for major purchases like trucks, equipment, and even real estate deals. With access to up to $250,000 – $500,000 in business credit, it’s possible to cover bigger investments while keeping repayment terms flexible and, in many cases, interest-free during introductory periods.

Business credit also supports growth for newer businesses or self-employed professionals who want to build financial strength without taking on traditional debt. A freelance web designer could use a business credit card to invest in new equipment, marketing, or larger projects, helping them scale faster without tying up cash reserves.

A business loan, on the other hand, can still be a good choice if you prefer a large lump sum with a fixed repayment schedule. For example, a construction company might take out a $200,000 business loan to fund a major multi-phase project with predictable monthly payments over a set term.

Some businesses end up using both. For instance, a restaurant owner might take out a business loan to complete major renovations, while using a business credit line to handle new equipment purchases, inventory restocking, or seasonal marketing campaigns.

Fund&Grow Can Help You Secure Up to $250,000 With 0% Interest!

Finding the right funding can feel confusing, but it doesn't have to be. Fund&Grow helps business owners access up to $250,000 in 0% interest business credit through a smart, guided process.

The first step is reviewing your current credit situation. If anything needs improvement, we show you exactly what to fix and how to fix it. Once your profile is ready, we help you apply for the right types of business credit at the right time, protecting your credit score along the way.

Our service is built around a done-with-you model. That means real experts work with you throughout the process. You will not have to figure things out on your own or risk making expensive mistakes. Every move is strategic and designed to maximize your funding potential.

Contact us now to get started!

About the Author:

About the Author:

Ari Page is the Founder and CEO of Fund&Grow, helping entrepreneurs, investors, and small business owners secure $50,000–$250,000 in 0% interest business credit cards. Since 2007, he has grown Fund&Grow into an Inc. 5000 company, securing nearly $2 billion in business credit for thousands of clients. With 6,000+ 4.9-star reviews and an A+ BBB rating, Fund&Grow is a trusted leader in business credit card stacking. Ari is also the author of Fund&Grow: Easy & Affordable Ways to Get Money for Your Business and a passionate advocate for mindset, success, and the Law of Attraction. He lives in Spring Hill, FL, inspiring others to grow their businesses and achieve financial freedom.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share