In addition to paying their employees, business owners must oversee key aspects of their tax obligations.

Managing this task can be difficult, but with proper guidance, it becomes easier.

Once you hire your first employee, you are responsible for payroll taxes.

Payroll taxes refers to all taxes paid on the wages of your employees.

You will be required to deduct a portion of employee wages to pay certain taxes on their behalf and pay payroll taxes from your revenue on each of your employees.

If you’re a business without employees, you will still be responsible for remitting payroll taxes for yourself since you’re self-employed.

Thus, you will be responsible for paying 15.3% of your net business income to payroll taxes since you take on both roles of employer and employee.

Types of Payroll Taxes

Two payroll taxes to be aware of are FICA and FUTA taxes.

FICA (Federal Insurance Contributions Act) taxes cover social security and Medicare. These costs get equally split between the employer and employee.

Each party is responsible for 6.2% for social security and 1.45% for Medicare. As the employer, you must withhold the taxes from your employee’s paycheck and pay it to the tax authorities are on their behalf.

These rates apply to employees who made less than $137,700 in 2020 and less than $142,800 for 2021.

Secondly, the FUTA (Federal Unemployment Tax Act) tax is designated to help pay for state unemployment agencies.

Like FICA, the cost is split between employer and employee equally, and the employee’s contribution gets withheld from their paycheck.

The FUTA tax rate is 6% on the first $7,000 of wages paid to employees within a calendar year.

In most cases, employers only have to pay 0.6% because the state receives the other 5.4% as a credit to help with the cost.

State and Local Payroll Taxes

In addition to federal taxes, employers are responsible for paying state and local payroll taxes, again on behalf of the employee.

Every state has different tax rules since the state and local levels govern the tax rates.

At the end of each year, you must prepare and file Form W-2 to report wages, tips, and any other compensation paid to employees. You send this information to the Social Security Administration using a Form W-3.

Calculating Federal Income Tax

The income you withhold for your employees gets remitted to the federal, state, and local tax authorities quarterly.

To calculate how much you should withhold from your employee’s income, you will need a copy of their W-4 and gross pay.

Most business owners use the wage bracket method to calculate how much they should withhold since it is the most straightforward approach.

The Wage Bracket Method

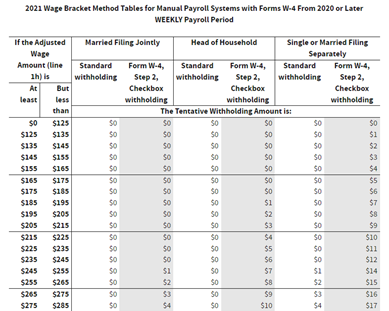

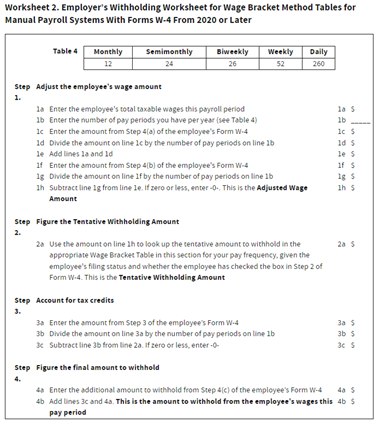

First, find the “Wage Bracket Percentage Method Tables” in IRS Publication 15-T. In the same IRS Publication, you will find a step-by-step worksheet to walk you through calculating the withholdings. They should look something like this:

Use the employee’s Form W-4 to determine how they file income tax (married or single) and the number of allowances they claim.

Additionally, be sure to check if the employee requested you withhold additional taxes from their paycheck on their Form W-4.

Using the table, worksheet, employee’s W-4, and employee’s gross pay, you can complete the steps to calculate how much you should withhold for federal income tax purposes.

Next, calculate how much to withhold for FICA and how much you will pay as your share.

How to Make Payroll Payments

Once you have calculated how much income to withhold, the hard part is over and making the payments is quite simple.

To make your payments, enroll in the Electronic Federal Tax Payment System (EFTPS) to make your online payments.

This is the only method accepted, so mailing your check-in would not be acceptable.

After making your payroll tax payments, you can move on to other tasks that require your attention.

Although payroll taxes can be time-consuming, it doesn’t have to be a daunting task.

Moreover, since your portion is a business expense, you can write it off come tax time, giving your business small tax savings boost.

DISCLAIMER: Any advice relating to finance, investments, stocks, companies, securities, or any other financial matters whatsoever reflects the private opinion of the person giving this advice. It is not the advice of a financial, investment, or other expert. Fund&Grow, its employees, and representatives take no responsibility for any consequences resulting from following such advice. Anyone seeking professional advice is strongly advised to conduct their own research or consult a professional financial adviser. Do not disregard professional financial opinion or make any financial decisions based on what you may read in Fund&Grow's Blog. You are solely responsible for any investment or other finance-related decisions you make.

Want to read our featured articles?

Top Tips to Reduce Your Business's Tax Liability

Steer Clear of these Budget Killing Google Ad Mistakes

How Cost Segregation Can Help You Minimize Tax on Real Estate Investments

Like our content and want even more useful and powerful information to grow your business and advance in life faster?

Consider subscribing to “Prosperity Pulse”, our Premium Monthly Premium Coaching, where you can find the latest strategies, information, and resources on business development, entrepreneurship, marketing, finance, real estate, as well as Personal and Business credit.

It’s also where we share exclusive 0% APR Business and Personal Credit Card offers that just hit the market and the most impactful industry trends. You can also expect to hear from our internal industry specialist team at Fund&Grow for instantly applicable tips and tools to help you experience personal growth and business prosperity.

About Prosperity Pulse:

Whether you just launched a start-up or you’re already a seasoned entrepreneur, Prosperity Pulse will provide actionable methods to improve your day-to-day business operations and achieve maximum sustainable growth.

In our Premium Coaching, you’ll read content-packed articles on credit & financial education, inspirational content-packed tips, resources from our industry experts, and tons of actionable content to save you precious energy, money, and time along your entrepreneurial journey.

Prosperity Pulse is the ultimate premium coaching that will connect you to the latest business and entrepreneurial trends in the marketplace so you can act on them before the competition.

Not only will you get a digital copy of the premium coaching, but we will mail you a physical print version each month. Click here to sign-up for Prosperity Pulse.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share