** DRAFT - NOT PUBLICALLY VISIBLE **

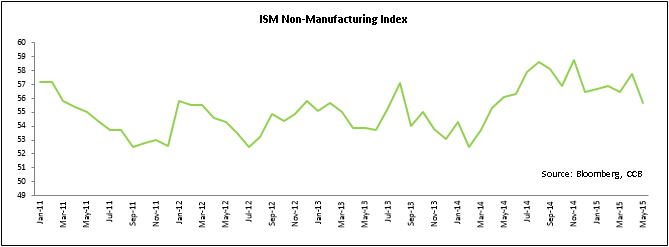

The U.S. service sector expansion eased in May, falling back from a five-month high in April, on weaker non-manufacturing business activity along with new orders and employment, according to data released Wednesday by the Institute for Supply Management (ISM). This was in contrast to a higher than expected rise in the Manufacturing activities reported on Tuesday. The ISM Non Manufacturing Index, a measure of service sector performance slipped to 55.7 from 57.8 in April. The drop in the Index was higher than the consensus estimate of 57.0. Nonetheless, the Index was well above 50 indicating expansion in the service sector.

The decline in the headline Index was primarily driven by a 2.1 percentage point fall in the ISM’s Non-Manufacturing Business Activity composite Index to 59.5 in May. The Index shrunk to its lowest level in 13-months but was still above 50. The New Orders index fell to 57.9 from 59.2 and the Employment Index decreased 1.4 points to 55.3 from 56.7. The Prices Paid Index rose to 55.9 from 50.1 in April, with the higher cost of input prices slightly offset by lower oil prices which reduced costs. The Exports index jumped to 55.0 after it fell sharply to 48.5 in April from 59.0 in March. Service exports are rising, particularly in transportation, warehousing and the entertainment industry, which probably are more immune to the rising dollar.

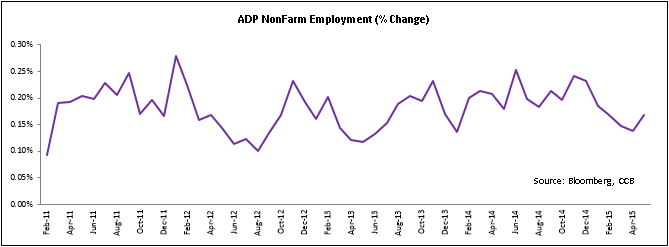

Although the non-manufacturing sector is growing at a slower pace, it has led to a surge in the employment levels. The latest report from ADP indicates that the private sector added 201,000 jobs in May, exceeding an estimate of +200,000 jobs. Earlier in April, about 165,000 jobs were created, the lowest since January 2014. The overall unemployment rate was at 5.4%, near to its seven-year low. The Fed will be closely watching reports on the job market to make a decision on a rate hike that is expected in September of this year.

The US trade deficit fell sharply in April as exports posted a modest gain and a larger decline in imports, raising hopes that the economy would post a better growth rate in the 2Q15. The April trade deficit moved down 19.2% to $40.9 from $50.6 billion in March, the Commerce Department said on Wednesday.

The drop in the trade deficit was higher than the market estimates of $44.0 billion. The nine-month west coast port labour disputes had dragged the March deficit to the highest level since the end of 2008, which led to a negative gross domestic product growth of -0.7% in 1Q15. Exports inched up 1% Month-over-Month (MoM) while Imports slid 3.3% MoM. The rise in exports represented an increase in oil shipments as well as aircrafts, telecommunication equipment, autos, and heavy machinery. The port disputes have been recently resolved, which has been reflected in the fall in imports.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share