Consumer prices posted the biggest gains in May over the last two years, triggered by a surge in oil prices. The Consumer Price Index (CPI), a measure of the price movement of goods and services bought for consumption, advanced 0.4% month-over-month (MoM) in May, the Department of Labor said on Thursday.

The market had expected a large 0.5% gain in the May CPI from a 0.1% rise in April. Cost of gasoline shot up by 10.4% in May, the biggest increase since June 2009, after declining for nearly a year, and is boosting consumer prices.

Food prices were consistent in May for the second straight month. However, food prices are expected to go up, due to the shortage of eggs on account of the outbreak of Bird Flu in some parts of the country.

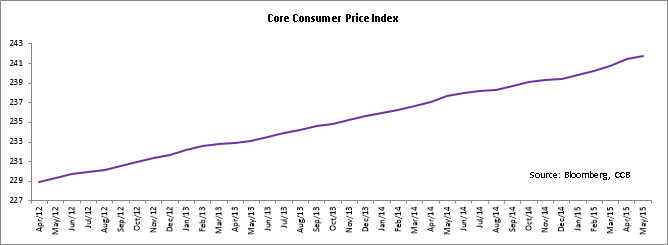

Excluding volatile food and energy prices, the Core CPI remained soft and gained 0.1% MoM in May, slightly below the last month’s gain of 0.3% MoM and market expectations of 0.2%. The smallest rise in inflation since December last year was due to a decline in the price of clothing and household furnishings. The cost of clothing and used cars and trucks in May recorded their biggest declines this year, and hotel rates dropped by the most over the last 18 months.

Medical care expenses inched up 0.2%, following a 0.7% rise in April. In the past year, overall inflation has remained unchanged, while core inflation is up just 1.7% vs. a 1.8% rise in the last year period. Both are reflecting modest inflation pressures.

While energy prices are stabilizing, a strong dollar is holding back inflation pressures. The U.S. Fed has targeted the inflation rate of 2% as one of the objectives for a short term interest rate hike. The Central Bank on Wednesday stated that energy prices are stabilizing and inflation will gradually move toward its 2% target. The Fed has kept its short-term lending rate near zero since December 2008.

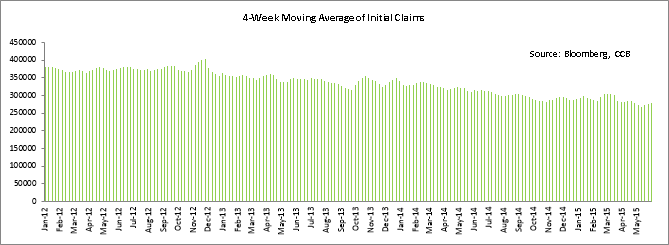

In a separate government report, initial jobless claims were lower than the forecasts last week. The number of applications for unemployment benefits declined by 12,000 in the week ended June 13 to 267,000. This is the lowest level since early May, the Labor Department reported on Thursday. The 4-week moving average, a better measure of the labor market trends as it rules out weekly volatility, declined to 276,750 in May from 278,750 in the prior month.

The U.S. current account deficit increased in the first three months of the year. The current account deficit is the gap between exports and imports. The deficit widened to $113.3 bn in the 1Q15, the largest in almost three years, from $103.1 bn at the end of 2014. The market expected a trade deficit of $116.8bn in the first quarter.

The current account deficit represents 2.6% of the GDP in 1Q15, the highest since 3Q12, from 2.3% in the 4Q14. In the first quarter, direct investment income receipts from abroad fell $9.1 bn to $109.5 bn, while exports of goods shrunk 6.5% to $382.7 bn, the lowest level since 3Q11, reflecting the impact of labor disruptions at the West Coast ports.

An appreciating dollar has hurt U.S. export businesses and made imports attractive, which has led to a rising current account deficit. The dollar rate increased about 4.5% against the currencies of the United States’ main trading partners in the first quarter. Multinationals, like Microsoft, Procter & Gamble and Johnson & Johnson, have notified that the dollar will negatively impact sales and profits this year.

Popular Posts

Instantly Pre-Qualify

Want Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

I take tremendous pride in building positive and lasting relationships in my businesses and personal life. Every member of my team is committed to helping our clients get the maximum amount of funding possible and achieve their highest growth potential.

Share

Share