How to Create an FAQ Section That's Engaging & Helpful

July 22, 2024 A well-crafted Frequently Asked Questions (FAQ) section can be transformative for your business. It quickly answers common queries, freeing your support team for more complex issues. This resource improves customer satisfaction and enhances the user experience, driving engagement and loyalty. An effective FAQ section clarifies confusion, builds trust, and boosts conversions. Offering easy acc...

The 5 Best Free HR Software in 2024

July 15, 2024 HR software has emerged as a vital asset for businesses across the board, proving particularly crucial for small enterprises. Faced with limited resources and manpower, these small entities are compelled to enhance operational efficiency, ensure compliance, and manage their workforce effectively. HR software plays a pivotal role in achieving these objectives, so this guide spotlights the best free...

How to Find Product-Market Fit: Strategies and Challenges

July 8, 2024 Product-market fit (PMF) is a critical milestone for startups and businesses. It refers to the stage where a company has found a strong match between its product and the market it serves. Determining how to find product-market fit and achieve it is essential for long-term success, as it signifies sufficient demand for the product and customers are highly satisfied with it. In this articl...

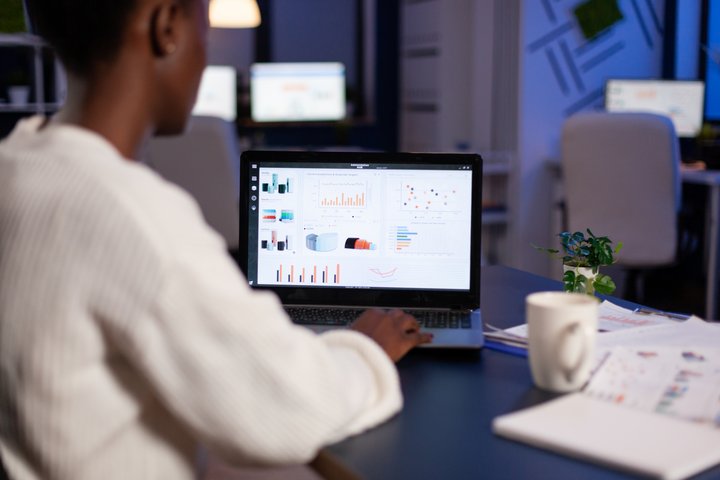

How to Do A/B Testing: The Dos and Don'ts for Successful Optimization

July 1, 2024 A/B testing, or split testing, is crucial in making data-driven decisions in various industries. Whether designing a website, creating an email campaign, or launching a new product feature, A/B testing allows businesses to compare two versions of something and determine which one performs better. While it can provide valuable insights and inform business strategies, there are several cautions to k...

How to Identify Your Target Audience and Successfully Leverage Insights

June 24, 2024 Imagine launching a message into the vast expanse of the digital universe, only for it to land precisely in the lap of someone who looks up, eyes wide, and says, "This is exactly what I have been looking for!" Fortunately, this is precisely what happens when you correctly identify your target audience. In an environment overwhelmed with choices and information, the ability to stand out and directl...

Merchant Services vs. POS Systems: What's The Difference?

June 17, 2024 In an age where success hinges on efficiency and seamless operations, small enterprises and burgeoning startups face a crucial intersection of technological functionality—merchant services vs. POS systems. This dynamic duo powers the financial heartbeat of modern commerce and holds the ace up your business's sleeve for maintaining customer satisfaction. Navigating these waters can ...

/102

Popular Posts Instantly Pre-QualifyWant Actionable Information, Tools and Resources To Quickly Acquire Business Capital, Credit and Funding?

have a question? Our business experts are available to answer questions Monday - Friday from 9:00 a.m. - 7:00 p.m. EST Call Us: (800) 996-0270 Email Us: service@fundandgrow.com Watch our business credit webinar: Obtain $250,000 Business Credit Let's Stay Connected on Social Media! |

For over 15 years, Fund&Grow has helped 30,000+ business owners get access to over 1.6 Billion dollars of business funding. We're on a mission to empower the small business owner by helping them tap into the smartest form of funding: Unsecured Business Credit – so that they can achieve their goals and dreams.

Contact

Information

"Fund&Grow was created to empower small business owners, but more importantly, to support entreprenuers in achieving their business and personal goals while they lead the way towards innovation." - Ari Page CEO of Fund&Grow

Ari Page and the Fund&Grow team help business owners obtain access to credit despite the ambiguous lending climate. Many people feel ripped off and scammed by the bank bailouts and wonder why they can't use the system to their advantage the way the big banks did. If you have good credit, the Fund&Grow program will get you the funds you need to grow your business.

Find 4,000+ 4.9-star average customer testimonials on the following platforms: SoTellUs, Trustpilot, Google, BBB, among others.

All credit is subject to lender approval based upon credit criteria. Up to $250,000 in business credit is for highly qualified clients over the term of the membership with multiple credit card batches and/or credit lines. Introductory rates of 0% apply to purchases and/or balance transfers after which it reverts to an interest rate, which varies by lender as disclosed in the lending agreement. Fund&Grow is not a lender.

© 2023 Fund&Grow. All Rights Reserved.

Share

Share